Precious metals appear to be recovering nicely after Wednesday’s punitive selloff. Although we initially assumed it might take a few weeks for gold and silver to build a base for the next moon shot, yesterday’s price action hinted that bullion quotes could be off and running much sooner. To be sure, the price action yesterday just inches from ground zero was relatively timid, with small gains driving the markets. However, that was to be expected, given the ferocity of the previous day’s plunge. It would have scared hell out of many investors, turning them cautious for the time being. But perhaps not for long. What was most encouraging about yesterday’s rally was its calmness, with relatively few of the whoops, feints and dives that characterize nervous markets. In fact, bulls made their ascent the way an experienced rock climber would scale an imposing cliff – i.e., one secure handhold/foothold at a time.

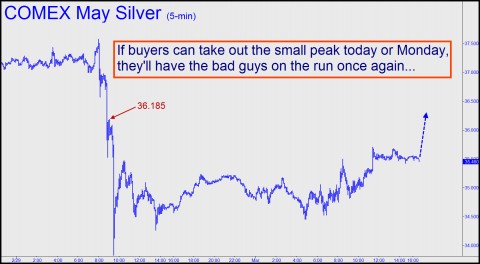

From a technical standpoint, the chart above shows what Comex May Silver must do before we assume that the trauma from Wednesday’s shock-and-awe selloff has mostly worn off. If you happen to trade the metals, we’d recommend setting an alert a tick above the highlighted peak at 36.185; for that is where bulls will once again have the bad guys on the run. The peak may not look like much – in the parlance of our proprietary Hidden Pivot Method, it is known as a “peak along the wall” — but it can be quite useful for purposes of gauging the determination and confidence of buyers. And if they’ve got the guts we think they’ve got, they should be able to push the futures through the resistance today or perhaps Sunday night with little or no evidence of deflection. [Follow the action from ringside with a free trial subscription to Rick’s Picks]

Shades of ‘Easy Al’

In effect, they would be saying they don’t give a rat’s ass about “Helicopter Ben” Bernanke’s testimony before Congress the other day. No one is quite sure what the Fed Chairman said, let alone what he meant. But you can hardly blame the guy for using “Easy Al” Greenspan’s tactic of speaking meaningless drivel when the goal is to obfuscate the ugly, inescapable truth that the global financial system is headed for collapse. Wall Street probably cares less about this than you might think, since its denizens are wont to assume that any spectacular move in the markets, be it up or down, represents opportunity. The hubris of this line of thinking was nicely described by one Robert Mockan, posting at the web site of our friend Max Keiser yesterday in response to our commentary. Mockan noticed something that had caught our attention as well – that with currency and bullion futures in a state of hysteria on Wednesday, the stock market barely budged. “The market moved a little,” wrote Mockan, “but not nearly what it should have if there was anything legitimate happening. All the USD base forex currency pairs crashed. And the manipulation was very well executed. Positive feedback was increased and we saw large percentage losses in everything that traders had positions open. Insiders knew the score and they raked it in.” As they probably did. Or didn’t you know that it’s a rigged game?

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

Cam – No (again, wrong). Gary – Yes, it’ll shine next year & the year after. Love reading you characters (-: