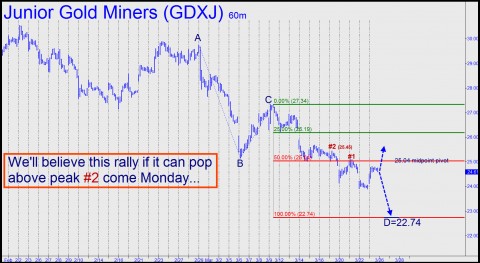

The week ended on an encouraging note for bullion investors, but can we trust this rally? Only with caution. Our hunch is that it was a false start and that precious-metal futures and mining stocks will re-test their recent lows. This puts in doubt a profitable long position we’d recommended in GDXJ, the Junior Gold Miner ETF. Our suggested entry point at 23.93 was hit on Thursday, three cents from the low. The number is a “Hidden Pivot support” that we’d disseminated to subscribers when GDXJ was trading above $26. We’d like to think the trade will work out beautifully, meaning an eventual doubler to $50 a share. Even so, we’ve already taken a precautionary step by closing out half of the initial position on the very small paper gain that existed prior to yesterday’s rally.

Although we’ve characterized our short-term bearish outlook as a “hunch,” it is buttressed by technical reasoning. What concerns us most is the heavy look of bullion-sector charts even after Friday’s rally. Indeed, there is such clarity in the larger, downtrending patterns on these charts that their respective downside targets look almost magnetic. You can see this in the GDXJ chart above – and you don’t need to be a graduate of the Hidden Pivot Course to sense the earnestness of the selling. The ABC price points established a bearish Hidden Pivot target at 22.74 that lies $1.16 beneath the low where subscribers were advised to get on board. Notice as well that the upper red line – what we call a “midpoint support” – appears to have mutated into resistance.

Not Goldman Sachs

Now, if this were a stock that we love to hate — Goldman Sachs springs to mind — we’d probably tell subscribers to reverse their long positions and go short near the 25.04 midpoint. But because this is a gold-mining stock, we’re inclined to give it the benefit of the doubt. Even then, however, we have our rules. In this case, we’ll need to see the creation of a bullish “impulse leg” on the hourly chart before we sound the all-clear. That would take an unpaused thrust above both of the labeled peaks, #1 and #2.

Meanwhile, much as we’d like to hang onto our existing long position and ride it into the blue, we wouldn’t be too terribly disappointed to have another buying opportunity down at 22.74.

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

Thanks for all the bright dialogue amigos.

Ruining money, markets and people to save banks does not compute nor last long with We The People. It leads to DHS FEMA Police State American concentration camps.

At least $5 bread and fuel may mean no more 0, unless courts, congress and elections are rigged again.

MR is more of the same ol’ war profiteering that bankrupted us since 1984.

There seems to be lots of bear capitulation today, but as ever, I leave ST timing to Rick.

The good doctor Paul and I are the only Constitutional Candidates I know, while MSM and RNC did their worst to destroy his candidacy. It ain’t over until Tampa and November 6.

People going along to get along may reap the whirlwind, if Bear, GS, JPM, Lehman and 0MFG were not enough wake up calls.

Gary, I keep on dialoguing with you: the latest is shadowstats.com 1980 methodology CPI is up over +11%, anything but tame inflation.

We were at -.89% 10-year TIPS auction last week with -3% asset deflation and 11% CPI. Guess who gets reamed? Paper hangers.

During the last great Depression we had negative nominal yields and positive real yields, currently 6.3% on the Long Bond. But we also had savings.

If that is not negative and destructive of free equity markets that cannot keep up with rising costs, what is?

Common sense simple spoken ARCO Chaplain friend Lindsey Williams said we will see the destruction of the dollar this year and oil will hit new highs under a Muslim President putting Al Qaeda and the Muslim Brotherhood in power while canceling Keystone XL completion.

Google Liberty Rig on Gull Island coming online summer of 2013 as a backup.

What does it profit to have a higher SPX, when in real terms of silver, the SPX is down -88% since 1999?

Maybe worth investing 42 minutes for the big picture:

http://bit.ly/H8iDaU

Meanwhile, Rick does a pretty good job short term…