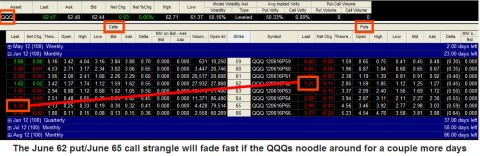

With the Dow down almost 200 points yesterday, we were kicking ourselves for having scratched a bearish “strangle” position in the QQQs the day before. We’d been long the June 65 calls and June 62 puts in a slightly bearish ratio, having paid a relatively whopping $444 for this high-leverage bet on volatility. We say “a whopping $444” because it is only on very occasions that Rick’s Picks has recommended taking positions with puts and/or calls that risked more than theoretical nickels and dimes. Usually, we try to leg into vertical spreads or butterflies so that risk has been reduced in theory to zero (or less, if possible, since one can sometimes leg into vertical bull or bear spreads so that they are carried, effectively, for a net credit).

Just this once however, we’d justified entering the trade on the prospect of an avalanche in stocks to kick off what is looking increasingly like a nascent bear market. But straddle bets are expensive, akin to betting on longshots at the race track. And with June expiration stealing up on option-premium buyers — essentially, retail suckers — there was risk that the remaining time premium would implode if the broad averages noodled around for more than another day or two. Friday would come, and it would dawn on the rubes that expiration lay just three weeks down the road – on the 15th of the month, the earliest expiration date possible, since June 1 falls on a Friday.

We Remain Skeptical

And so, bearish as we were – still are – we decided to cut and run. The decision looked like perfectly bad timing yesterday around mid-morning, when stocks were getting schmeissed. Fortunately, however, the decision to exit the strangle with neither a gain nor a loss proved to have been a stroke of luck when shares came roaring back to close unchanged on the day. (The Dow recorded a statistically negligible loss of 6.66 points.) Although we remain skeptical toward the blitzkrieg rally that recouped yesterday’s big losses in the final 90 minutes of the session, we’d rather pick a new entry point and start over, perhaps by buying July or August puts at the top of this presumably phony rally.

We usually tell subscribers who are interested in learning about options not to waste their time, since reading books on the subject and paper-trading for five years will only teach you enough to lose less than those who merely dabble in options. In fact, it takes every trick we’ve learned in nearly 40 years of options trading, 12 of them on the exchange floor, just to swing the odds mildly in our flavor. If you’re interested in our approach, click here for a free trial subscription and a ringside seat for the next trade.

Rick, Mario, Mark, also very bearish.

Hate to buy bad news, but it can profit.

Some Ranked Ideas/Targets Thursday 24 May 2012:

BAC +185%

MU +184%

JPM +142%

PHM +131%

WYN +104%

SUN + 95%

DHI +90%

DF +77%

PFE + 42%

EDV +34%

SPY +28%

EXPE +27%

VOO +27%

INTC +23%

GE + 22%

QQQ +19%

Silver still the Silver Senator’s biggest holding.

Cheers*Rich