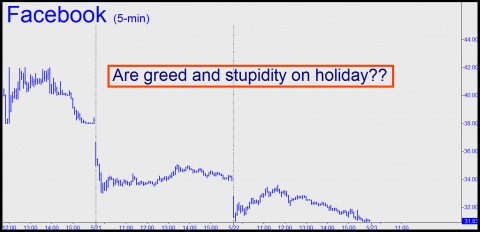

Observing Facebook’s price action on its IPO day earlier this week, one might have thought that fear, greed and stupidity had taken the day off. How could the over-hyped, socko-boffo stock of the year – of the decade – have failed to double within minutes of the opening bell? In fact, pumped to a $38 initial-offering price, FB shares achieved only a pathetic $45 on the opening bar before detumescing back to $38 by day’s end. Even more dispiriting to those on the retail end of Thursday’s relatively unfrenzied buying was that, on day two, the stock collapsed to $33 in the early minutes of the session, there to languish for six grueling, armpit-staining hours. Retail suckers…er, buyers were bound to have been disappointed, and some, more than a little churlish about it, labeled the IPO a flop. Had the guys on Sand Hill road and their sleazy confederates on the Wall Street Midway simply overpriced the stock, as some suggested? Or was GM perhaps to blame for pulling its advertising from Facebook days before the Big Event because of poor results? Some observers even speculated that investors had finally wised up to the fact that companies with relatively modest revenues deserve relatively modest earnings multiples.

That last notion, that investors have finally wised up, is so absolutely outlandish that we were impelled to seek a better explanation. Since when has a price/earnings multiple of 108 ever deterred buyers salivating with greed from the certitude that a greater fool would take them out of the stock at even richer prices?

Why No Moon Shot?

Our take is that speculators failed to achieve the expected moon shot, not because they were at long last thinking rationally about the IPO market in general, and Facebook in particular, but because they were weighed down almost to the point of suffocation by a stock market in its sixth straight day of decline — and very possibly in the nascent stage of a bear market. If, as they say, timing is everything, then Facebook and all of the hucksters who reaped huge profits at the expense of retail buyers simply picked the wrong day.

This could haunt them for years to come, since the skepticism evinced by the IPO is bound to mutate into lingering doubts about Facebook’s revenue model. Indeed, one might ask, how will the company ramp up advertising aggressively, exploiting a reported 900 billion pairs of eyeballs, without becoming an increasing annoyance to subscribers? More immediately, though, the fact that the IPO laid an egg is going to invite intensive scrutiny of the company’s quarterly earnings. It will come on the heels of an SEC filing by Facebook that said revenues and user growth are actually slowing. Considering all the hoopla and hubris that attended the public offering, it already feels like it’s destined to become the bell that rang to signal the end of the Mother of All Bear Rallies begun on Wall Street a little more than three years ago. (Click here for a free trial to Rick’s Picks, including actionable daily trading recommendations and access to a 24/7 chat room that draws veteran traders from around the world.)

A loner here. I still believe the political atmosphere favors deficit cutting over most anything else. Polls seem to indicate that. As long as we muddle thru this mess without a full blown depression politicians on both sides will be pushing their deficit ideas and debating which one is right for Americans.

My theory should be tested at the end of this year. A combination of cuts and increased upper-end taxes will most likely result.