[What happens when a $2.4 billion casino-hotel fails? It’s never happened before, but we may find out if Revel, Atlantic City’s spectacular new pleasure palace, continues to take in far less each month than is required to service debt from its mountainous construction costs. We asked our good friend Mike Schurr for his thoughts on this topic. A Philadelphia real estate developer who summers in downbeach Margate where we grew up, Mike sees big trouble ahead — not only for Revel’s financial backers, but for Atlantic City itself. RA]

I’m not an expert on many topics, but with twenty five years in the real estate business and Jersey Shore vacations that stretch back to my childhood, I know a thing or two about the intersection of these subjects. First let me begin by saying there are a few places on earth that I love more than Margate, New Jersey. The beach, the smell of the ocean, the ability to bike everywhere and the close proximity to the poker rooms of Atlantic City make this small town a gem of a resort, at least for me. The proximity to Atlantic City, which lies on the same 8-mile-long island, is both a blessing and a curse, but that’s a story for another day. For decades, visionaries have touted Atlantic City as America’s Playground, with dreams of palatial casinos and resorts attracting the masses from all points north, south and west. I on the other hand view the town as a colossal failure in urban renewal and a notorious center of political graft and corruption.

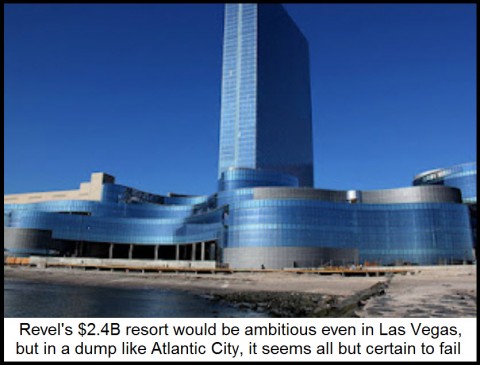

The latest in a series of missteps, one that proves there is no such thing as a deal Wall Street doesn’t like, is the recently opened Revel Resort. Although a book could be written about how not to fix Atlantic City, Revel has proven once again that the “build it and they will come” mantra is fatally flawed. Revel was conceived in the early 2000s and funded by Morgan Stanley to the tune of $2.4 billion when construction started just before the Great Financial Collapse. By late 2008, with the project less than 50% complete, Morgan Stanley bailed out with a $1 billion loss. But Revel got a new lease on life as 2011 began when veteran casino executive Kevin De Sanctis took over, bolstered by a $260 million tax credit from New Jersey and a complicated $1.1 billion loan. Thereafter, in May, the casino resort officially opened, with Governor Christie calling it “crucial for Atlantic City’s success.” More than 700 feet in height, Revel is the second tallest building in New Jersey, and its 6.5 million square feet of interior space dwarfs all of its casino competitors. These statistics may seem impressive, but when one considers that Revel’s monthly profits so far have placed it at the bottom of the casino pack, the monstrosity at the end of the Boardwalk isn’t so impressive.

‘Tidy Bowl’ Effect

Metaphorically speaking, you could say that Atlantic City is a toilet and Revel is the Tidy Bowl Man. And we all know what happens to that little boat when the toilet is flushed. Not only has Revel sucked the taxpayers of New Jersey into its vortex, but with them went any hope of revitalizing Atlantic City. Revel was probably doomed from the start, a case of too much, too late in a resort that peaked more than fifty years ago. Revel’s marketing strategy sounded good, but it was like putting lipstick on a pig. Revel had not wanted to be viewed as just another casino, but rather as a place where affluent young professionals from New York and other East Coast metropolises could buy $1000 bottles of vodka and dance until sunrise, eat in swanky restaurants and spend $500 per night on a hotel room. There was only one problem: few showed up to take advantage of these pleasures, and those that did had to cross through a ghetto to get to the center of a town whose only amenity besides casinos is an outlet mall.

Atlantic City didn’t need Revel’s $500 million night club just to attract the likes of Snooky, Vinny and The Situation. It certainly didn’t need a resort where only a handful of restaurants are busy enough to stay open, where gamblers aren’t allowed to smoke, and where just getting around can be so confusing that you need bread crumbs to find your way back to your car. Concerning the smoking ban, 80% of the gamblers I know smoke and drink, so why in the world would you build a casino where you can’t smoke and drinks are $15? Revel may not have wanted to be “just” a casino, but without casino revenues, it will not be able to keep the lights on.

A Perfect Storm

So there you have it: a resort that can’t attract guests, in a town that nobody wants to visit, financed by bondholders who have no idea what they own, backed by a state government that has promised millions to create jobs that won’t materialize, and a management team that is oblivious to the reality of casino gaming. To make matters worse, if that were possible, a man is in critical condition after falling from the floating escalators that ascend through midair and connect the hotel to the casino floor.

So what will become of Revel? I imagine a bond holder cram-down, some favorable subsidies from Trenton and a partial mothballing of portions of the hotel. The new owner, whoever it is, will try to make a go of a $500 million nightclub for the Jersey Shore crowd. Long term, The Revel, along with most or all of its competitors, will slip deeper into the red, fall into neglect, and perhaps get demolished as several casinos already have been. At that point, the only thing that will remain in Atlantic City are saltwater taffy wrappers, pawn shops, a large homeless population, and hundreds of prostitutes that ply their trade on Pacific Avenue, a block from the beach and Boardwalk.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

I think I chose the name “Leipzig” because I liked the sound of it. Dresden’s a downer with the firebomb roasting of people in their basements, Berlin is too mentally accessible. I’m a poet, you see 😉