Apple shares have looked like hell lately. Given the stock’s uber-bellwether status, can the broad averages be far behind? Probably not — and that’s notwithstanding the very bullish projection we put out a while ago for the Dow Industrials. It called for a 1400-point rally to exactly 14969, and although we no longer believe the Dow can get there by election day, the target remains theoretically viable nonetheless. As a practical matter, though, we have set all of our chart-based tripwires on “hair-trigger” lest we miss the onslaught of a 2500-point plunge. That’s how much we think the market will fall, at a minimum, when the cliff dive so many of us have been expecting for so long finally comes.

The technical logic behind our bullish Dow forecast is that the blue chip average exceeded a “midpoint Hidden Pivot resistance” at 13502 on September 13. Moreover, it did so with considerable force and then appeared to consolidate above the pivot for nearly a week. Taken together, these signs were unmistakably bullish, and, going by-the-book, the 14969 rally target will

stand until such time as the Dow breaches a key low at 12035 from a year ago. Even so, we always keep an open mind and an alert eye, since bullish technical indicators, even long-term ones, can sometimes change overnight. For the moment, however, you can infer that we are reluctant bulls: extremely bearish in our outlook for the U.S. and global economies, but compelled by our mechanical indicators to call things exactly as we see them.

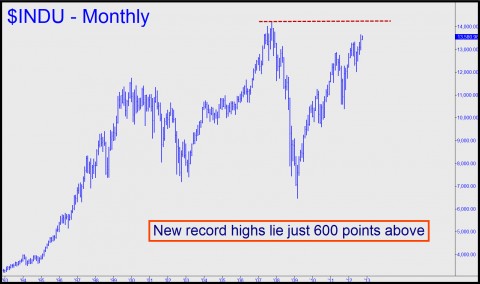

One Other Factor

Besides the stratospheric Dow target, there is another factor that could conceivably buttress the bullish argument for a last-gasp rally. To wit, the Dow is within 600 points of record highs (see chart above). If you accept the premise that Mr Market is out to cripple, maim, defenestrate and destroy as many investors as possible, a run-up to just above the old high, 14198, would seem well nigh irresistible to Him. Think of the hubris it would generate…the inescapable hook it would set.

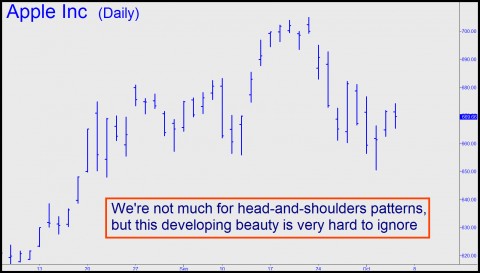

But there’s still Apple — in dollar terms the most valuable company in the world — to reckon with. The stock has looked awful lately, perhaps because investors sense that it could be a while before the company tops the bullish crescendo leading up to iPhone 5’s release. The phone itself has reportedly been a disappointment with buyers, even if it’s not possible for an item that sells so many millions of units to be judged a flop. But what will Apple do next? That question should be on the minds of investors who have held the stock through thick and thick with the idea that things will only get better. Perhaps not, at least for a while.

Also, we mentioned here earlier that it will be far more difficult for Apple to negotiate cut-throat deals with TV sports, TV entertainment, TV films and TV news than it was for Steve Jobs to make the recording industry his bitch. Whatever happens, we no longer expect Apple to provide robust leadership for the broad averages in the months ahead. If the Dow is about to head-fake its way to new all-time highs nonetheless, it will be dragging Apple higher, not the other way around. Can bulls boost the blue chip average by 600 points with a 2000-pound gorilla clinging to their ankle? We’ll remain open minded to the possibility even as we continue to straddle the forecast with one leg out the fire escape.

***

[For further details concerning the Hidden Pivot Method, click here for a free trial subscription that includes access to Rick’s Picks 24/7 chat room and the just-launched ‘Harry’s Place’.]

John–

True– although I have a feeling we are paying just a wee bit more to the TBTF banks, the military industrial complex, the big pharmaceutical companies, healthcare companies, huge oil companies that get big government subsidies etc. than to the folks on Disability. However, I do agree that everyone who is capable of supporting themselves should get off the dole. It is entirely ridiculous.