Traders should still be long two dozen March 30-33 call spreads for a 12.5-cent credit. We stand to make as much as $7500 by expiration, but the worst we can do in any case is come away with a $300 gain before commissions. The spread settled yesterday @ 0.82, implying a paper gain so far of $1134. I’d be inclined to close out the position if we can extract profits of at least $3000 by mid-December, but otherwise we’ll let it run, since the factors that have been driving the stock are only just starting to percolate. Here’s what the San Jose Mercury had to say earlier this week: “Facebook’s stock surged more than 8 percent Monday, briefly passing the $26 mark for the first time since July, amid signs that Wall Street is regaining some of its lost confidence in the social-networking service’s ability to make money.” This is exactly why we jumped on the stock when it was trading 50% lower just two weeks ago. (Note: It ended last week at 28.11, a recovery high.)

Traders should still be long two dozen March 30-33 call spreads for a 12.5-cent credit. We stand to make as much as $7500 by expiration, but the worst we can do in any case is come away with a $300 gain before commissions. The spread settled yesterday @ 0.82, implying a paper gain so far of $1134. I’d be inclined to close out the position if we can extract profits of at least $3000 by mid-December, but otherwise we’ll let it run, since the factors that have been driving the stock are only just starting to percolate. Here’s what the San Jose Mercury had to say earlier this week: “Facebook’s stock surged more than 8 percent Monday, briefly passing the $26 mark for the first time since July, amid signs that Wall Street is regaining some of its lost confidence in the social-networking service’s ability to make money.” This is exactly why we jumped on the stock when it was trading 50% lower just two weeks ago. (Note: It ended last week at 28.11, a recovery high.)

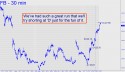

Since we’re sitting so fat, let’s fool around with the stock today, shorting the 27.95 target shown with a tight stop-loss. Specifically, you are to offer 400 shares short for 27.93, stop 28.01. Cover half on a pullback to 27.40, and await further instructions in the chat room and via the subscriber ‘E-Mail Notifications’ feature (if you are signed up for it). We are doing this simply for the fun of it, and because our spread position will offset most of any loss. Here’s why: Each spread we hold has a delta value of about 13 shares at these levels, making us long the equivalent of about 312 shares. At the 27.95 target, however, because the March 30 calls we are long would pick up more deltas than the March 33 calls we are short, our position would automatically gain perhaps 50-60 total deltas, making us long the equivalent of about 370 shares. The inset chows the option calculator that I used to determine these values. ________ UPDATE (December 2, 6:06 p.m. EST): I’ll assume nothing done on the short, since my post Friday in the chat room advised against initiating a trade if the target was hit in the final hour. In fact, the target was hit in the final 30 seconds of the session as we might have expected, given Mr. Market’s predictable proclivity for mischief. Need I mention that anyone who holds the March 30-33 call spread as we do should be pleased to see bears still hanging on the ropes at the final bell on Friday? _______ UPDATE (December 27, 3:07 p.m. EST): My apologies for not posting an in-one’s-face correction target at 25.79 earlier. Today’s so-far low at 25.52 is not enough of an overshoot to worry about, although, because it created a bearish impulse leg on the hourly chart, we should monitor the c-d follow-through closely for signs of further weakness.

Since we’re sitting so fat, let’s fool around with the stock today, shorting the 27.95 target shown with a tight stop-loss. Specifically, you are to offer 400 shares short for 27.93, stop 28.01. Cover half on a pullback to 27.40, and await further instructions in the chat room and via the subscriber ‘E-Mail Notifications’ feature (if you are signed up for it). We are doing this simply for the fun of it, and because our spread position will offset most of any loss. Here’s why: Each spread we hold has a delta value of about 13 shares at these levels, making us long the equivalent of about 312 shares. At the 27.95 target, however, because the March 30 calls we are long would pick up more deltas than the March 33 calls we are short, our position would automatically gain perhaps 50-60 total deltas, making us long the equivalent of about 370 shares. The inset chows the option calculator that I used to determine these values. ________ UPDATE (December 2, 6:06 p.m. EST): I’ll assume nothing done on the short, since my post Friday in the chat room advised against initiating a trade if the target was hit in the final hour. In fact, the target was hit in the final 30 seconds of the session as we might have expected, given Mr. Market’s predictable proclivity for mischief. Need I mention that anyone who holds the March 30-33 call spread as we do should be pleased to see bears still hanging on the ropes at the final bell on Friday? _______ UPDATE (December 27, 3:07 p.m. EST): My apologies for not posting an in-one’s-face correction target at 25.79 earlier. Today’s so-far low at 25.52 is not enough of an overshoot to worry about, although, because it created a bearish impulse leg on the hourly chart, we should monitor the c-d follow-through closely for signs of further weakness.