The chart below comes from Doug Behnfield, a friend who is also the savviest and most successful financial advisor we know. Doug has been a bear’s bear for years, and to stay on the cutting edge, he talks almost daily with guys who turn up regularly on the network business channels and in interviews with major-league financial publications. He has produced stellar returns for his clients, mainly by keeping them well weighted in Treasuries. That strategy might seem like a no-brainer these days, especially with the long-term bonds in a vertical climb for the last month. But he has held this position through thick and thin, even at times when such savvy bettors as Pimco’s Bill Gross were throwing in the towel.

No doubt, Doug likes to keep most closely in touch with economists and gurus who share his bearish point of view. It’s not a matter of misery loving company, either. The stock market has indeed vexed bears by climbing a steep wall of worry. And now, flouting the palpable threat of a downturn in corporate earnings, the Dow Industrials are making new all-time highs regularly. More than ever, the question tormenting bears is: How could investors be so stupid? For the permabear, there will always be comfort in talking to guys who can reel off a dozen good reasons why stocks are about to collapse. But that’s not why Doug talks to them. Rather, he does so because he has the rare ability to reduce a hundred well informed opinions into a compact and logical set of facts that will consistently make his clients money.

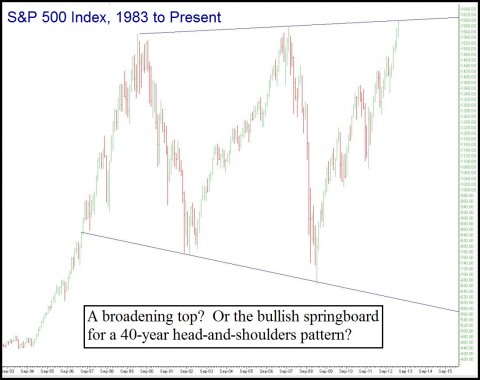

A Key Resistance

So what do we make of his chart, which shows price action for the S&P 500 going back 20 years? Doug is laser-focused on just one detail: the intersection this week of manic buying spree and long-term trendline. Will the trendline hold? Regardless, Doug says this is no time to buy stocks, nor to put one’s faith in the “linear” argument that shares cannot possibly go down while the Fed is easing so aggressively. Playing devil’s advocate, we disagreed, observing that if share prices were to double over the next five years, which they conceivably could, the broad topping pattern he discerns could become the extremely bullish left shoulder of a giant head-and-shoulders pattern that by the time it is completed will have taken half a lifetime to construct.

Not that we actually believe this could happen. It’s just a thought. But “believing” has little value in this game, as we’ve learned time and again over the course of nearly 40 years of market-watching. What matters most to us is what the charts are saying, and right now their message is: Stand aside if you’re so foolish as to think you know how it will all turn out. However, being the inveterate bears we are, it was too tempting to pass up an opportunity to get short at these levels. Both the E-Mini futures and the Diamonds are trading within a hair of some key rally targets of ours (click here to find out where they are via a free week of Rick’s Picks), and it would be irresponsible for us to fail to take advantage of them. Odds will always be heavily against nailing the exact top of a rally that is now in its fifth year. However,using tight stops, we can at least attempt it without getting hurt too badly if we are wrong.

It’s about time China took on the power elite criminals in the USA and liquidated some of their treasuries for physical gold. Bring ’em down.