We often tell subscribers to leave options trading to the experts, since, for retail customers, the game is almost as tough to beat as betting on horses. But not quite. We’ve been at it for 40 years ourselves, and the knowledge we’ve accumulated over that time, including a dozen years making markets on the floor of the Pacific Exchange, has helped push us just past the 50 yard line that divides winners from losers. Which is to say, we come to each trade with a positive expectation. A case in point is a bull play in Goldman Sachs that we recommended nearly three months ago. Back in March, we reckoned that if the stock market were to go bonkers, as it indeed has, then Goldman would almost surely be one of the stocks leading the charge. This idea proved flat-out wrong, but as you’re about to see, not fatal.

We had told subscribers to buy far-out-of-the-money Goldman calls to leverage the scenario, but because we were attempting to buy them at fire-sale prices, the options stayed just out of reach. Until one day, that is, when the stock got sacked. That was on April 1, and when the dust had settled, we were able to write as follows: “With Goldman shares at a precipice, the July 195 calls we’ve been attempting to steal came cascading down on us yesterday like summer rain. I’ll treat the order to buy 20 of them @ 0.15 as filled, but as long as DaBoyz are jumping out of windows, let’s try to suck up another dozen, bidding 0.12 for them, good-till-canceled. Be warned that I am suggesting this because it looks like the stock will fall a further $3, to at least 143.58 (see inset), before it can turn around.” [This is in fact what happened.]

Flouting Our Forecast

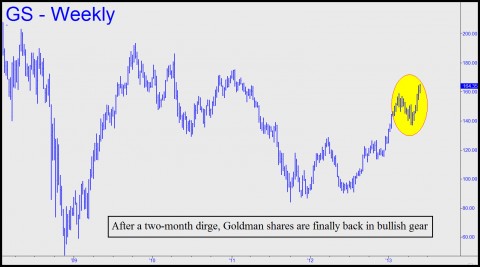

By the final bell, subscribers reported buying 32 of the calls for an average 0.14 (i.e., $14 per 100-share contract). Unfortunately, the calls went nowhere for a month while Goldman shares languished, flouting our expectations as the broad averages went bonkers. We eventually gave up on the trade and told subscribers to resign themselves to a $448 loss. Cut to yesterday. The stock has finally lurched into bullish gear, even racking up a $2.06 gain the other day when the broad averages were falling out of bed. This has enabled us, finally, to put on the second leg of the vertical bull spread we’d originally planned. To accomplish this, we shorted 32 July 200 calls for 0.15 against the July 195 calls we’d bought nearly two months earlier for 0.14. Anyone who legged into the spread as advised now owns a virtually riskless play in Goldman with a potential $16,000 payoff. Even after commissions this position will have no cost, since we shorted the July 200s for a little more than we paid for the 195s. Now, if Goldman continues to forge higher over the next seven weeks, it’ll be like holding a winning lottery ticket that we got for free. Incidentally, you could buy the July 195-200 spread today for around 0.15 (that’s $480 for 32 spreads), but that wouldn’t be good enough. The trick is to put on spreads for nothing, since even when you are experienced enough to do it for almost nothing, the game will nickel-and-dime you to death over time. Guaranteed.

For the retail customer, this is how Rick’s Picks believes the options game should be played: legging into riskless spreads rather than simply buying puts or calls based on bullish or bearish hunches. We use “Hidden Pivot” targets to time our initial entry. If we get the “buy” side of the trade on just as the stock is about to reverse, in theory it will be a piece of cake to leg into the short side at a price that makes it impossible to lose. Get it right and you can make money if only one trade in ten comes home. And if Goldman should slip back into a funk, what do we care? On the other hand, let the stock continue to waft toward $200 from a current $164, and we’ll be partying come August. If you’ve cursed time decay on most of the options trades you’ve made, or followed other gurus whose results always seemed to beat yours, consider trying our “camouflage” method of trading. Click here for a free trial subscription, including access to our 24/7 chat room, intraday updates and alerts, an daily trading “touts”.

My apologies for not doing it right Rick. I actually could only trade even nickels on options via my broker at that time, so I instead went straight to a 190-205 July spread for .10 each on 30 contracts. If GS can’t break 190 in July, I am out $356, but dare I dream of Rich’s $208 and 45K? I will surely take your course if it happens. 🙂

Apparently I can now trade options to the penny, so at least I have broader choices now.

I bought SLW Sept-13 $38 today @.11, my first trade since those GS options. Real heavy player I am.

&&&&&

I can’t emphasize too strongly that, if you are to get an edge with options, you must make certain that every penny counts. This should start with the acknowledgement that straight directional plays based on hunches will lose perhaps 99% of the time. Also, since time is working against you on all long-premium strategies, you’ll need to sell something against the calls — September 40s, say, for 0.12.

If you bought the Sep 38s at yesterday’s lows, and the purchase was based on SLW’s having reached some downside target, then you are on the right track. Now, you should try to spread them off, offering September 40s or 41s short for more than you paid for the 38s. RA