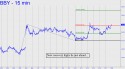

It’s one thing to wish Best Buy well as it attempts to survive the blight that has all but wiped big-box stores from the retail landscape. But the odds are daunting and growing still moreso each time the company changes leadership at the top (which lately has been all too frequently). Wall Street has bought into BBY’s story as though a turnaround were a fait accompli, but I’ll suggesting fading the institutional action by buying puts if and when the stock closely approaches the 27.37 target shown. Specifically, you should buy four July 25 puts with the stock trading 27.32 or higher. Stop yourself out if they trade for 0.20 less than the acquisition price. _______ UPDATE (May 7, 11:04 p.m. EDT): No point in getting in the way of this projectile, since it remains a strong stock in a strong market. Looking at it from the bright side, my minimum upside projection is now 27.82, a Hidden Pivot midpoint, but any higher would put a 33.09 target in play. (see new chart.) Let’s try a low-risk speculation by legging into some butterfly spreads centered on the 33 strike. To start, buy eight July 30-33 spreads in a 1:2 ratio for a 0.05 credit._______ UPDATE (May 20, 3:56 a.m.): BBY topped at 27.15 on May 14 but now looks bound for higher highs. You should use 28.60 as a minimum upside projection over the near term (see inset), but be alert to a possible stall at the 27.65 midpoint pivot of a lesser pattern. _______ UPDATE (May 28): The stall occurred at 27.37, just 28 cents from the midpoint resistance noted above. The subseqent dive to 25.17 created a bearish impulse leg, so a short fron 28.60 should be put out of mind for now. ________ UPDATE (June 3, 2:12 p.m.): DaSleazeballs sprang a nasty bull trap this morning that hit 28.37 on the opening bar. Anyone attempting to get short at the 28.60 target flagged above would have been shut out of the trade. Because it took five weeks to reach the target, that should be it for a while.

It’s one thing to wish Best Buy well as it attempts to survive the blight that has all but wiped big-box stores from the retail landscape. But the odds are daunting and growing still moreso each time the company changes leadership at the top (which lately has been all too frequently). Wall Street has bought into BBY’s story as though a turnaround were a fait accompli, but I’ll suggesting fading the institutional action by buying puts if and when the stock closely approaches the 27.37 target shown. Specifically, you should buy four July 25 puts with the stock trading 27.32 or higher. Stop yourself out if they trade for 0.20 less than the acquisition price. _______ UPDATE (May 7, 11:04 p.m. EDT): No point in getting in the way of this projectile, since it remains a strong stock in a strong market. Looking at it from the bright side, my minimum upside projection is now 27.82, a Hidden Pivot midpoint, but any higher would put a 33.09 target in play. (see new chart.) Let’s try a low-risk speculation by legging into some butterfly spreads centered on the 33 strike. To start, buy eight July 30-33 spreads in a 1:2 ratio for a 0.05 credit._______ UPDATE (May 20, 3:56 a.m.): BBY topped at 27.15 on May 14 but now looks bound for higher highs. You should use 28.60 as a minimum upside projection over the near term (see inset), but be alert to a possible stall at the 27.65 midpoint pivot of a lesser pattern. _______ UPDATE (May 28): The stall occurred at 27.37, just 28 cents from the midpoint resistance noted above. The subseqent dive to 25.17 created a bearish impulse leg, so a short fron 28.60 should be put out of mind for now. ________ UPDATE (June 3, 2:12 p.m.): DaSleazeballs sprang a nasty bull trap this morning that hit 28.37 on the opening bar. Anyone attempting to get short at the 28.60 target flagged above would have been shut out of the trade. Because it took five weeks to reach the target, that should be it for a while.