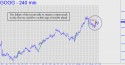

Much as we’ve come to view the stock market as a one-way bet these days, so have we come to accept that Google will eventually sell for $1000 a share. Or will it? I’d need odds to bet the “Don’t Pass” line on this one, but it is at least curious that the stock’s most recent rally failed by a hair to surpass a small but technically significant ‘external’ peak at 892.14 that I’ve labeled in the chart. As we know, rallies that are destined for bigger things don’t usually hesitate at such trivial obstacles, but in this case Google did.

Much as we’ve come to view the stock market as a one-way bet these days, so have we come to accept that Google will eventually sell for $1000 a share. Or will it? I’d need odds to bet the “Don’t Pass” line on this one, but it is at least curious that the stock’s most recent rally failed by a hair to surpass a small but technically significant ‘external’ peak at 892.14 that I’ve labeled in the chart. As we know, rallies that are destined for bigger things don’t usually hesitate at such trivial obstacles, but in this case Google did.

If you look closely at similar rallies in the chart, you’ll see that in each instance where there was a small peak that required just a smidgen more effort to exceed, the stock did not fail. GOOG could still surpass 892.14 on the next thrust, but as we know, it’s the first attempt that defines whether buyers have the moxie to keep on going. I raise this point speculatively, of course, and Google will still be on a nice ‘camo’ buy signal if it gets past 892.14 and pulls back from just above it. But we should nonetheless note the small failure that has already occurred as a very subtle warning sign of possible trouble ahead.