So certain was I that this vehicle would plummet to exactly 159.80 on Friday that I added the following note to my tout, which suggested bottom-fishing at that price: “The Devil himself could not entirely avoid a Hidden Pivot as clear as this one.” In the actual event, DIA fell to 159.88, prompting the following email message from a subscriber who recently took the Hidden Pivot Course: “I am unable to stop myself from sending this email. There are D targets and then there are D targets. This was the latter one!!!! I am talking about the DIA target you had for Friday. I have attached the chart you put out. In the tout you said, ‘The Devil himself could not entirely avoid a Hidden Pivot as clear as this one‘.

So certain was I that this vehicle would plummet to exactly 159.80 on Friday that I added the following note to my tout, which suggested bottom-fishing at that price: “The Devil himself could not entirely avoid a Hidden Pivot as clear as this one.” In the actual event, DIA fell to 159.88, prompting the following email message from a subscriber who recently took the Hidden Pivot Course: “I am unable to stop myself from sending this email. There are D targets and then there are D targets. This was the latter one!!!! I am talking about the DIA target you had for Friday. I have attached the chart you put out. In the tout you said, ‘The Devil himself could not entirely avoid a Hidden Pivot as clear as this one‘.

“There were lots of times on Friday when it looked like the market would bounce and never get even close to your target, but you had this relentless confidence on this target. (I don’t care that it did not reach the exact target). Your confidence gave me the confidence to not cover my positions when DIA bounced from around 160.25 at 10:20am to 161.25. I really want to learn how you could have such a high confidence in this pattern ? You are the only [guru] I have ever met who is honest, which is why I am asking you this question. Being a good student and learning is more important to me than just getting trade recommendations. TK.”

First, TK, let me tell you how pleased I am to hear from a subscriber who profited from the tout. The fact that you were able to do even though I missed the low of Friday’s $1.59 plunge by 8 cents attests not only to your diligence, but to your willingness to use my numbers aggressively to suit your own style and goals. That is what I strive for in my students, since I have never believed it possible to get rich by blindly following someone else’s advice.

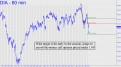

As to my confidence in the target, I can only say that it felt like a winner because the pattern that produced it was so clear. In my trading course, as you know, I stress the importance of simply looking at the big picture, and of seeing what there is to be seen, before considering any rules. Sometimes the best opportunities are the obvious ones, and that, I think, was the case here. I have reproduced the original chart so that you can see for yourself: Occasionally, ABCD patterns are so graceful and, if I may put it this way, so lovely, that they just ‘feel’ like they are going to work. Relative to the simple Hidden Pivot criteria we use, and visually speaking, this pattern had nearly everything going for it. That said, some students may have noticed that if I had not lazily ignored one of my own rules — i.e., use a one-off high rather than the obvious one as point ‘A’ — I could have gotten four cents closer to nailing the actual low.