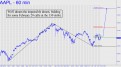

We shouldn’t doubt that Apple will eventually lift off for points north — most immediately the 116.92 midpoint Hidden Pivot shown, and thence its ‘D’ sibling at 129.20. In the meantime, the presumptive consolidation near 110 has brough only tedium and a more or less predictable series of false starts. The timing of the rally is of some importance, since the stock market as a whole cannot get in bullish gear without the world’s most valuable stock leading the charge. For our part, let’s get our feet wet with a 0.31 bid for 16 Feb 20 130 calls, day order, contingent on the stock trading 109.00 or higher. If Apple falls below that price lower the bid to 0.26. Our eventual goal will be to leg into some vertical spreads for cheap, or possibly free. ______ UPDATE: The calls traded for 0.31 on the opening, so I’ll track 16 of them at that price. Use a stop-loss at 0.24 for now, o-c-o with an order to short 16 Feb 20 135 calls for 0.31. ________UPDATE (January 18, 7:03 p.m.): The stock has looked like hell lately, stopping us out of the calls for 0.24 on the opening Friday. The loss would have totaled $112 plus commissions. We’ll back away for now, since AAPL now looks primed to fall to 103.58 before bulls get traction. ______ UPDATE (January 25, 11:04 p.m.): The stock has reversed sharply to the upside, putting the 129.20 rally target flagged above solidly in play.

We shouldn’t doubt that Apple will eventually lift off for points north — most immediately the 116.92 midpoint Hidden Pivot shown, and thence its ‘D’ sibling at 129.20. In the meantime, the presumptive consolidation near 110 has brough only tedium and a more or less predictable series of false starts. The timing of the rally is of some importance, since the stock market as a whole cannot get in bullish gear without the world’s most valuable stock leading the charge. For our part, let’s get our feet wet with a 0.31 bid for 16 Feb 20 130 calls, day order, contingent on the stock trading 109.00 or higher. If Apple falls below that price lower the bid to 0.26. Our eventual goal will be to leg into some vertical spreads for cheap, or possibly free. ______ UPDATE: The calls traded for 0.31 on the opening, so I’ll track 16 of them at that price. Use a stop-loss at 0.24 for now, o-c-o with an order to short 16 Feb 20 135 calls for 0.31. ________UPDATE (January 18, 7:03 p.m.): The stock has looked like hell lately, stopping us out of the calls for 0.24 on the opening Friday. The loss would have totaled $112 plus commissions. We’ll back away for now, since AAPL now looks primed to fall to 103.58 before bulls get traction. ______ UPDATE (January 25, 11:04 p.m.): The stock has reversed sharply to the upside, putting the 129.20 rally target flagged above solidly in play.