[I am airing this for a second day so that readers are well prepared for Wednesday’s CPI data. It could significantly impact U.S. and global markets.] Bloomberg News has been drum-rolling Wednesday’ scheduled release of CPI data, since a report suggesting inflation has remained subdued will complicate the Fed’s task of convincing the world more tightening is urgently needed. Yellen & Co. gave up pretending inflation was a big problem a few months ago, ostensibly because the only place this seemed to be true — to an appalling degree — was in real estate and stocks. More recently, even with the Fed’s benighted lackeys in the news media blaring increasingly shrill warnings that inflation is about to return with a vengeance, no one seems panicked. Maybe it’s because American workers haven’t gotten a real pay raise in forty years. You can bet they’re not cheering for more tightening.

[I am airing this for a second day so that readers are well prepared for Wednesday’s CPI data. It could significantly impact U.S. and global markets.] Bloomberg News has been drum-rolling Wednesday’ scheduled release of CPI data, since a report suggesting inflation has remained subdued will complicate the Fed’s task of convincing the world more tightening is urgently needed. Yellen & Co. gave up pretending inflation was a big problem a few months ago, ostensibly because the only place this seemed to be true — to an appalling degree — was in real estate and stocks. More recently, even with the Fed’s benighted lackeys in the news media blaring increasingly shrill warnings that inflation is about to return with a vengeance, no one seems panicked. Maybe it’s because American workers haven’t gotten a real pay raise in forty years. You can bet they’re not cheering for more tightening.

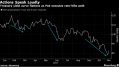

Meanwhile, bond markets have been acting as though higher administered rates are certain. But if October’s CPI number comes in at 1.7% as expected — or, heaven forbid, a little lower — look for the Fed to amp up its warnings about how a supposed global economic boom is about to touch off a spiral of inflation. I’ll believe it when workers start asking for, and getting, big pay raises. Until then, we should continue to regard each 25-basis-point hike by the Fed as another trigger-pull in a game of Russian roulette. Sooner or later, tightening, however timid and fake, is going to have its effect on the quadrillion dollar derivatives bubble — a cosmic-size juggernaut of potential deflation that someday will put the central banks’ awesomeness in a more sober perspective. (Click here for an explanation of how the flattest yield curve in more than a decade could eventually send the U.S. economy into deep recession.)

This Is Tightening!?

Incidentally, it is only economists, pundits and editorialists at such mainstream mouthpieces as the Wall Street Journal and New York Times where what the Fed has actually been doing could be called “tightening.” In reality, on a year-over-year basis, the monetary base has grown at a very accommodating 7.7% clip, free reserves are up 6.9%, M3 has grown 4%; and M1, 7.4%. If that’s tightening, then just a little more of it would amount to helicopter money.

Major tops and lows are breadth related, as towards volume has been eliminated from the equation, by a blow off in volume at highs, or the drying up of it at lows.

Breadth becomes the main force toward a larger shift in pricing a market, up and down tics are breathe. The recent plunge in breath by the MSI, RAMSI and MO are having readings under the zero level while all time highs in a churning market affect is taking place these straws are breaking the camel’s back.

Sentiment is a ‘pile on’ and at the ending phases breadth corrections get toward the point, that many see what is happening as an ‘internal correction’ a positive for there after more rising prices are ahead. Its at this point market turns are sudden and the breaking of levels are suggested as a drying up process towards lower levels, that the internal correction has a bit more to go. Allowing volume to be lighter in a water fall process, then changing towards gaps lower for panic to set in.