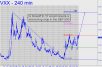

Incredible! The Dow swung 570 points on Tuesday without breaking above or below the previous day’s range. This is what chartists refer to as an “inside day.” In fact, the blue chip average didn’t traverse even half of Monday’s epic, 1214-point swing. Get used to the wild oscillations, since volatility is unlikely to subside until we come to regard a bet on more of it as a sure thing. Paradoxically, because the big moves up or down lately have more or less alternated from one day to the next, VXX, which measures short-term S&P volatility, has remained relatively subdued. Don’t dare let down your guard, though, because a blowoff to the 56.30 target (see inset) looks like a lead-pipe cinch. Unfortunately for investors, VXX could never reach such heights without a correspondingly wrenching selloff in the S&Ps. If the finishing stroke lends symmetry to the big pattern shown in the chart, the selloff will probably occur within the next 3-4 weeks. Although we’ll be able to say then that we were ready for the move — expecting it, even — don’t be surprised if whatever happens to cause VXX to hit 56.30 still seems shocking.

Incredible! The Dow swung 570 points on Tuesday without breaking above or below the previous day’s range. This is what chartists refer to as an “inside day.” In fact, the blue chip average didn’t traverse even half of Monday’s epic, 1214-point swing. Get used to the wild oscillations, since volatility is unlikely to subside until we come to regard a bet on more of it as a sure thing. Paradoxically, because the big moves up or down lately have more or less alternated from one day to the next, VXX, which measures short-term S&P volatility, has remained relatively subdued. Don’t dare let down your guard, though, because a blowoff to the 56.30 target (see inset) looks like a lead-pipe cinch. Unfortunately for investors, VXX could never reach such heights without a correspondingly wrenching selloff in the S&Ps. If the finishing stroke lends symmetry to the big pattern shown in the chart, the selloff will probably occur within the next 3-4 weeks. Although we’ll be able to say then that we were ready for the move — expecting it, even — don’t be surprised if whatever happens to cause VXX to hit 56.30 still seems shocking.

Volatility Indicator Says a Nasty Decline Is Lurking

- December 12, 2018, 12:57 pm

-

December 12, 2018, 9:55 am

“US Debt reaches $22 Trillion mark!”

And the Oligarch Narrative is……………….

” At this point, there is no possible scenario in which this story ends well…”

Hmmm…………….

Ends “Well” for whom?

The 1% or the 99%, that is the question!

I can think of a Scenario that ends well for the 99%

Just create a spreadsheet listing who owns all that debt.

And then make them “An offer they can’t refuse!”

Which makes more sense, and ends it just like that?

A-8 billion people work as eternal slaves to 1,000 thieving Oligarchs?

B- No more Oligarchs, and the world gets a Fresh Financial Start!

The Yellow Vests in France are stumbling towards the correct choice!

Denial stage:

The NYA 200 DMA indictor has created a new low at 19% of all listed stocks under the 200 DMA. This is the ‘slide’ and a denial stage in market thinking, in technical terms this is a -20% INDU correction level as indexes like RUT had hit.

This stage is a probing process for lower pricing, and over time lower highs and lows continue. Other markets should be closely observe now, as ZB (lower rates) GC, SI and DX move into a sneaking process of pricing, that these larger markets are turning under the table so to speak. Major currencies are to be observe towards shifting (upward as DX starts to fall).

ZB/SP at at contract highs and contract lows, this is a place for option players to make a rush into getting and printing more income. Moving along a type of bottom that seems to hold, could in turn become quite an event.

INDU/SP has increased over supply and the long trip down the rabbit hole seems to be a trend, longer in length and in time then many can image.

Have a great day Rick.