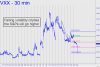

Stocks are in wafting mode, indifferent to tariff wars, slumping retail sales and impeachment talk. The broad averages have been racking up impressive gains even when buying interest is weak to nil. It certainly felt that way on Tuesday, when the Dow Industrials rose nearly 200 points on the opening bar, then hovered aloft for the rest of the day. For every tepid buyer it would seem that there is an even more tepid seller. The only stock that has attracted bears with some gumption is TSLA, which has been fighting for its life lately against a steady stream of ugly headlines. Short sellers had better make the most of enticing odds in the stock, since they’re not likely to catch a favorable breeze elsewhere. The chart (inset) shows VXX, which tracks short-term volatility in the S&Ps, headed at least 6% lower over the next day or two. If so, the index, currently trading for around 2864, is bound for 2900. Play the FAANGs, over-stoked as they are, and you can’t miss.

Stocks are in wafting mode, indifferent to tariff wars, slumping retail sales and impeachment talk. The broad averages have been racking up impressive gains even when buying interest is weak to nil. It certainly felt that way on Tuesday, when the Dow Industrials rose nearly 200 points on the opening bar, then hovered aloft for the rest of the day. For every tepid buyer it would seem that there is an even more tepid seller. The only stock that has attracted bears with some gumption is TSLA, which has been fighting for its life lately against a steady stream of ugly headlines. Short sellers had better make the most of enticing odds in the stock, since they’re not likely to catch a favorable breeze elsewhere. The chart (inset) shows VXX, which tracks short-term volatility in the S&Ps, headed at least 6% lower over the next day or two. If so, the index, currently trading for around 2864, is bound for 2900. Play the FAANGs, over-stoked as they are, and you can’t miss.

Inured to Bad News, Stocks Waft Higher

- May 22, 2019, 12:27 pm

-

May 22, 2019, 12:14 am

Rick- Although I can’t remember when you last reminded us that the markets are rigged… In this familiar context, we aren’t surprised to observe, “The broad averages have been racking up impressive gains even when buying interest is weak to nil.” Of course, I’m not offering a particularly compelling explanation. But, understanding that the markets are indeed rigged and playing along as best we can is, I imagine, all we can do to keep our sanity and make some money, too.

&&&&&&

That the markets are 100% rigged is the underlying conceit of my trading ‘touts’ and notes on the markets, Thomas. The NYSE, Nasdaq and all the rest are just glorified versions of the carnival midway. The only difference between carnys and Wall Street’s best and brightest is that the former do not have an supremely exalted sense of themselves. RA

Better make all you can while you can.

Eventually, the Neo Romanovs of this world will own it all, and then any wealth transfer will be via Arranged Marriages.

Since the reign of the last Romanov regime lasted 300 years, (1613 to 1917) our 100 year foray into “Democracy” is about at the end of it’s pendulum swing.

A nation of petulant, drug addled, violent, eight year olds are just incapable of self government, plenty of evidence for that!

And this time around the Romanovs won’t even need serfs, sharecroppers, or wage slaves working for script to spend at the Company Store.

Once they let the billions of useless Nasties die off it’s back to hunting estates the size of Montana!

It’s funny because it’s true!

LOL!