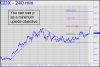

It has taken GDX more than four months to carve out a saucer bottom to correct last summer’s exuberant excesses. The bullishness of the chart shown is unmistakable, as is the 36.66 target. But first buyers will need to hit achieve 31.32, a midpoint resistance that can serve for now as our minimum upside objective. If it is decisively exceeded, especially on first contact, that would significantly shorten the odds of a continuation to at least p2=33.99, but more probably 36.66. As before, I am looking for help picking an entry spot, since this goal will be best served using an rABC entry set-up intraday. If you are interested in this stock, don’t just say so in the chat room; take a bold step forward and contribute to a common goal. _____ UPDATE (Jan 27, 10:01 a.m.): What gratuitous nastiness! Anyway, here’s a small bullish pattern with a 30.50 target you can use to trade this vehicle. A pullback to x=28.39 would trigger a ‘mechanical’ buy, stop 27.67. _______ UPDATE (Jan 28, 8:53 p.m.): Although there were 60 people in the trading today, only one reported having gotten long according to the instruction above. If a second subscriber chimes in, I’ll establish a tracking position of 400 shares; otherwise, GDX will come off the list for lack of interest. _______ UPDATE (Jan 29, 9:59 a.m.): The position is ‘official’. For now, use a stop-loss at 27.67. GDX has been swimming against a torrent of money flowing into the usual stocks, but it has been doing it well enough to suggest a gold rally is coming if bull-market mania ever takes a breather. _______ UPDATE (Jan 29, 9:28 p.m.): Offer 200 shares to close at 29.42, day order. _______ UPDATE (Jan 30, 4:35 p.m.): Even when it’s in a bull market, gold is easy to hate. We’ll have to put up with it as GDX gyrates wildly, nearly always opposite movement in the broad averages. They went nutty in the final hour today, reversing bullion’s solid gains in a trice.

It has taken GDX more than four months to carve out a saucer bottom to correct last summer’s exuberant excesses. The bullishness of the chart shown is unmistakable, as is the 36.66 target. But first buyers will need to hit achieve 31.32, a midpoint resistance that can serve for now as our minimum upside objective. If it is decisively exceeded, especially on first contact, that would significantly shorten the odds of a continuation to at least p2=33.99, but more probably 36.66. As before, I am looking for help picking an entry spot, since this goal will be best served using an rABC entry set-up intraday. If you are interested in this stock, don’t just say so in the chat room; take a bold step forward and contribute to a common goal. _____ UPDATE (Jan 27, 10:01 a.m.): What gratuitous nastiness! Anyway, here’s a small bullish pattern with a 30.50 target you can use to trade this vehicle. A pullback to x=28.39 would trigger a ‘mechanical’ buy, stop 27.67. _______ UPDATE (Jan 28, 8:53 p.m.): Although there were 60 people in the trading today, only one reported having gotten long according to the instruction above. If a second subscriber chimes in, I’ll establish a tracking position of 400 shares; otherwise, GDX will come off the list for lack of interest. _______ UPDATE (Jan 29, 9:59 a.m.): The position is ‘official’. For now, use a stop-loss at 27.67. GDX has been swimming against a torrent of money flowing into the usual stocks, but it has been doing it well enough to suggest a gold rally is coming if bull-market mania ever takes a breather. _______ UPDATE (Jan 29, 9:28 p.m.): Offer 200 shares to close at 29.42, day order. _______ UPDATE (Jan 30, 4:35 p.m.): Even when it’s in a bull market, gold is easy to hate. We’ll have to put up with it as GDX gyrates wildly, nearly always opposite movement in the broad averages. They went nutty in the final hour today, reversing bullion’s solid gains in a trice.