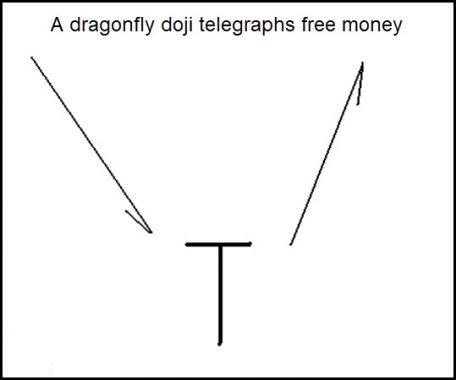

A wasteful, do-nothing day on Wall Street. The tedium is hard to fathom, considering how interesting these times are. The broad averages rose steeply in the first 90 minutes, then spent the remainder of the session giving it all back, although no more. For traders, the tedium could set up a test of whether it is better at the moment to view the glass as half-empty or half-full. Someone in the chat room said the day’s price action described a ‘flat abc’, an Elliott Wave term. This supposedly signifies a ‘wild-card’ day: pick ’em and take your chances. Candlestick chartists use ‘doji’ formations to draw similar inferences. For my part, I held no position at the bell and will be content to spectate when stocks open Friday morning. My gut feeling is that the gratuitous hump traced out by stocks on Thursday was just that: gratuitous. I still have outstanding rally targets for the S&Ps and AAPL, our favorite bellwether, that lie significantly higher. I could never be so certain of them, however, that I would take a position home over the weekend.

A wasteful, do-nothing day on Wall Street. The tedium is hard to fathom, considering how interesting these times are. The broad averages rose steeply in the first 90 minutes, then spent the remainder of the session giving it all back, although no more. For traders, the tedium could set up a test of whether it is better at the moment to view the glass as half-empty or half-full. Someone in the chat room said the day’s price action described a ‘flat abc’, an Elliott Wave term. This supposedly signifies a ‘wild-card’ day: pick ’em and take your chances. Candlestick chartists use ‘doji’ formations to draw similar inferences. For my part, I held no position at the bell and will be content to spectate when stocks open Friday morning. My gut feeling is that the gratuitous hump traced out by stocks on Thursday was just that: gratuitous. I still have outstanding rally targets for the S&Ps and AAPL, our favorite bellwether, that lie significantly higher. I could never be so certain of them, however, that I would take a position home over the weekend.

A Boring Day, but Why?

- April 25, 2020, 10:34 am

Hi Rick, I spotted an interesting set of 2 patterns in Delta Airlines (DAL) that brings us to negative stock value and perhaps ultimately bankruptcy? Here is the chart: https://www.loom.com/share/dca91865f992467a9a76d001082b634f