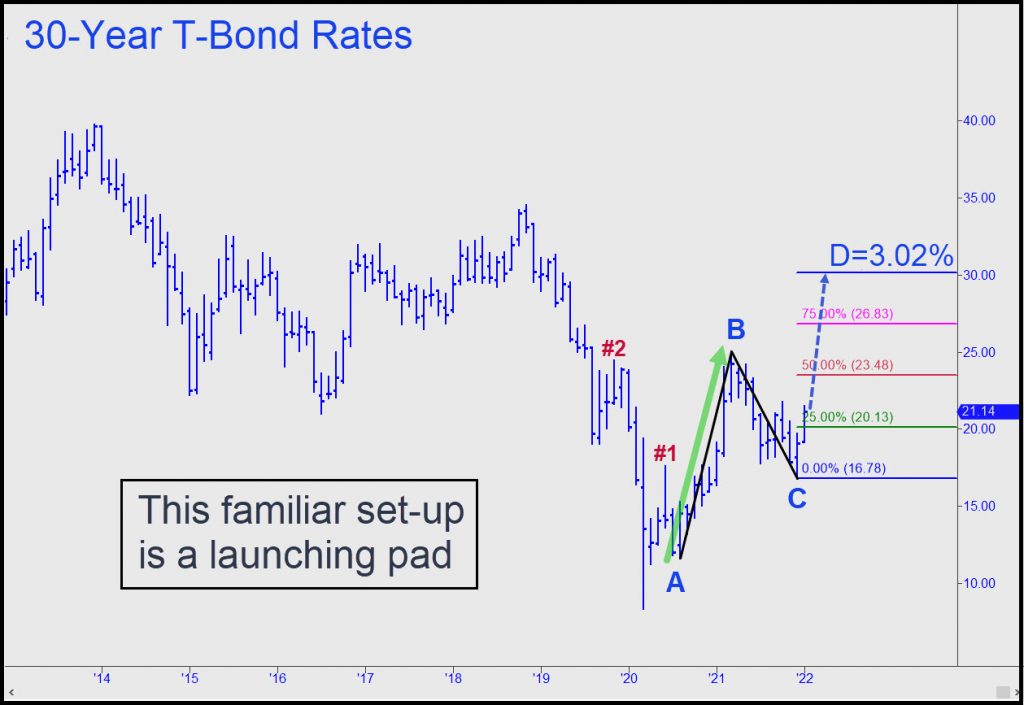

The chart above suggests that interest rates on 30-year T-bonds could be on their way up to 3.02%, a more than 40% increase over the current 2.11%. That is not necessarily bad news for investors, since a market adjustment of that magnitude would make it unnecessary for the Fed to tighten. It would also make it easier for the central bank to sell some of the $8Tr in U.S. debt currently sitting on its books.

As the Covid asset bubble has grown to gargantuan size, it has become increasingly clear that the Fed, for all its talk about tapering, has dreaded doing so. It would surely pop the bubble, triggering a bear market in stocks and, quite possibly, a deep economic depression.

A Market Adjustment

That’s why Powell has only talked about tightening credit. However, given the market adjustment this has helped cause, his do-nothing tactic appears to be working. If and when rates achieve 3%, it will give him room to ease. Also, a widening spread between short- and long-term rates will fatten bank profits by tens of billion of dollars.

A very small handful of contrarians have been saying the Fed’s next move will be to loosen, not tighten. This graph explain why they will be right. From a technical standpoint, the 3.02% target is not a done deal, however. Rates would need to blow past the ‘midpoint pivot’ at 2.35%, shown in the chart as a red line, to clinch a follow-through to 3.02%. But by merely surpassing the green line as they have done this month, they have put the 3.02% target in play. From a technical standpoint, it would be a huge blunder for Powell & Co. to tighten now. You can bet they won’t.

Rick, you’ve been on a roll.

Kudos.