Last week’s commentary was skeptical that the short squeeze begun two weeks ago in the broad averages would prove to be just a bear rally. Based on the latest technical evidence, it now seems likely that stocks are headed to new all-time highs. This is despite the fact that the world is going to hell in a handbasket, Biden’s wrecking-ball presidency has a thousand days to go, China and Russia have joined forces to hobble the U.S. however they can, and there is even talk that America could be in for its first-ever food shortage. This comes on top of soaring prices for gas, groceries and nearly everything else, as well as a looming earnings recession. Throw in Fed tightening to the horizon line and you have quite a list of things about which Wall Street evidently cares little if at all.

As always, we need look no further than Apple’s chart to understand exactly where the market is headed. AAPL is a perfect proxy for institutional mindset, a one-decision stock since 2009 that has made erstwhile chimpanzees look like geniuses. DaBoyz have hung together on AAPL for 13 years, selling almost none of it from their portfolios, and buying every dip. A 4-for-1 stock split back in August 2020 allowed the rubes and riff-raff to join in the fun — an opportunity to play AAPL stock and options with relatively small change. It became the biggest-cap stock in the world as a result and is likely to grow even fatter on perpetually spun news that, this time, it’s teaming up with Porsche to have yet another vague but promotable go at the car business.

Sunny and Mild: Ugh!

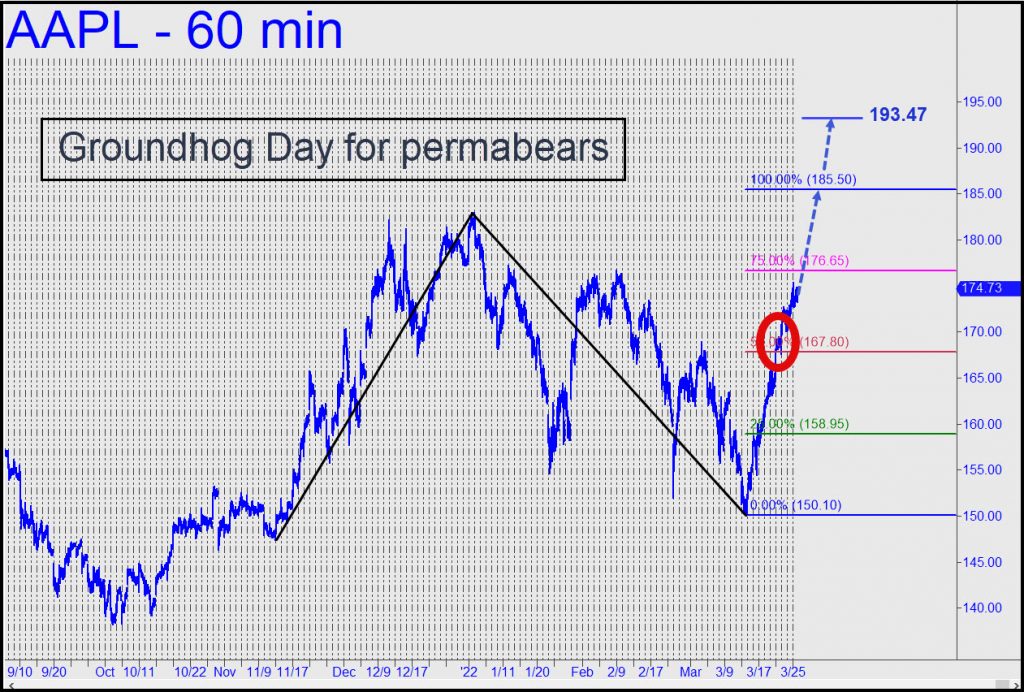

The chart shows that buyers shredded their way past a ‘midpoint Hidden Pivot’ at 167.80 last week. This all but clinched the subsequent 5% rally and minimum upside to the pink line, a ‘secondary’ pivot at 176.65. That is a place where bull moves can stall fatally, and the possibility cannot be ruled out. However, permabears shouldn’t get their hopes too high, since the impalement of p=167.80 was inversely akin to the groundhog seeing his shadow. He did, and it will likely spell at least six more weeks of sunny and mild weather to be endured by pessimists who think a correction worthy of the name is years overdue. If the move easily surpasses 176.50, you can count on more upside to at least 185.50, or even to 193.78. That would pull the stock market higher, postponing Papa Bear’s arrival yet again, as well as a day of reckoning for investors who long ago jettisoned the concept of value.

…bull moves can stall fatally, and the possibility cannot be ruled out.

Could not agree more Rick, particularly if logistics maestro Tim keeps cutting production on new products.

In fact, we could be in a typical bear market fast and furious rally as gamma pros squeeze sloppy shorts.

SHERF coming along nicely and SOXS beginning to move with 1:10 reverse split.

For cautious money, SPYD targets + 67 % from 43.605 to 72.6 with a 3.6 % dividend.

However, as MP Merrill Mentor advised, When they raid the house they take all the girls.

Caveat emptor all.