However high stocks climb, there will always be an earnest, bespectacled egghead on Wall Street ready to tell us why shares are likely to keep on rising. Here’s Yung-Yu Ma, chief Investment officer for a firm called BMO Wealth Management and a finance professor at Lehigh University: “A better economy, healthy profits and lower inflation,” he avers, are what have powered the stock market to its fourteenth gain in the last 15 weeks (a feat last accomplished 52 years ago), Better, healthier and lower than what? one might ask. If Mr. Yung is comparing the U.S. economy to that of Venezuela or West Virginia, then he is more or less correct: We are living in a relative economic paradise.

But at what cost? It has taken $2.5 trillion in fiscal stimulus to keep the U.S. out of statistical recession. This sum unfortunately has not slowed the commercial real estate market’s inexorable drift toward collapse. The coming plunge is certain to be steep, since more than $1 trillion in commercial mortgage loans will have to be refinanced over the next two years, at significantly higher rates and with property values already eroding dramatically.

To add force to the incipient downturn, layoffs are growing not just among world-beaters like Amazon and UPS, but in Silicon Valley. It is hardly reassuring that an ostensible offset — a supposed 353,000 jobs created in January — came mainly from a sector that produces exactly nothing: government.

Permabulls Nervous

Small wonder, then, that the stock market’s unjustified rise should have begun to worry even permabulls. Like the rest of us, they understand that the revelry has to end sometime, probably sooner rather than later. It is foreseeable that a top in the market will bring these illusory boom times to a halt, pushing the economy — and with it, let us hope, Taylor Swift hubris — into eclipse. What could be more quintessentially American than having a blowout Superbowl mark the end of the party?

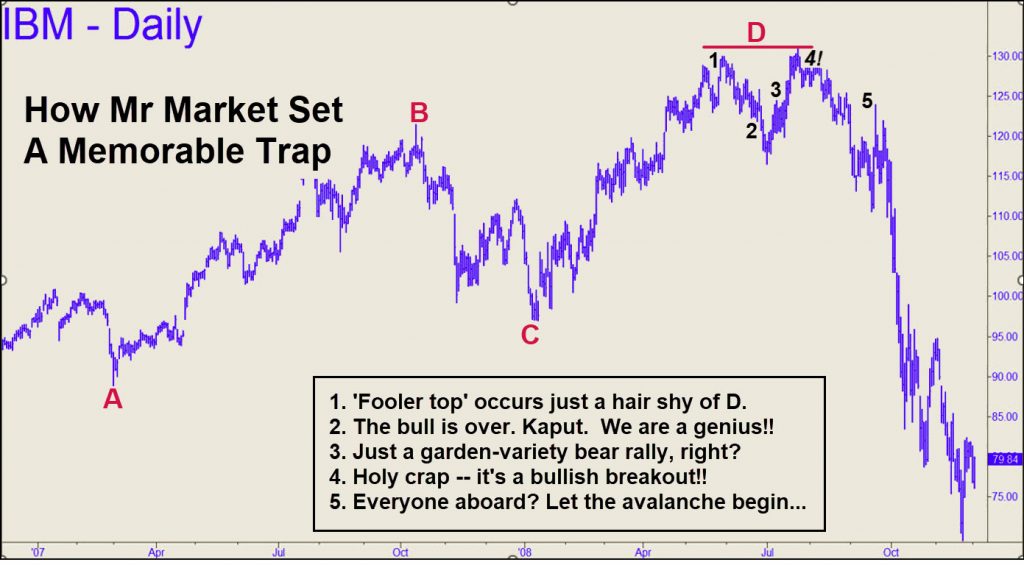

At the same time, MSFT has climbed to within $10 of a $430 bull market target Rick’s Picks has been drum-rolling for months. We are still predicting that this is where the bull market will end, but with a caveat: a headline forecast from some guru will never, ever get it exactly right, at least not in a way that is going to make everyone rich. The vintage IBM chart above describes an alternative scenario that will remain viable as long as there is a Mr. Market to severely rebuke the sin of hubris.

Notice that IBM initially turned down from within a millimeter of a bull-market Hidden Pivot target at D. A tumble ensued as expected, but after a short while, Big Blue bounced with the kind of manic vigor one expects from bear rallies fated to die. Lo, two months later, it feinted to a marginal new, record high, forcing bears to cover and bulls to believe the stock was blasting into outer space. The devastating avalanche that followed could only have occurred if investors were all-in. Keep this chart in mind if MSFT appears to top at $430. I am confident that a tradeable peak will occur at or near there. If it does so in the deceptive way IBM did, at least you won’t be caught unawares.