Some of you may remember Gary Liebowitz, a troll that I 86’d from the site years ago. He still harangues me now and then, and I am saddened to report that his rage has only worsened, especially where Trump is concerned. Here’s a pungent note from Gary that just plopped into my email box. I am reprinting it here because it casts him in a role he was born to play: useful idiot.

Your deflationary theory has already been proven wrong as the current market is careening towards a TOP as it and YOU ignore the real signs of a 40-year INFLATIONARY Cycle that has started. As predicted by Warren Buffet himself when discussing cycles. He acknowledged this pattern. The dollar is moving UP (WITH) rising Inflation. 10-year note will oblige. In an election year the FED will be FORCED to sit on its hand even if clear signs of inflation are seen.

Your refusal to accept the current reality matches you love of a fascist. From Rape, extortion, sedition, and treason there is no act Trump can commit that will allow you to change your mind. Rigid fanatical cult-like thinking is always a prescription for disaster. But since 50% of this nation believe as you, I can only conclude the recent fascist Hitler with his 12 year reign is more common and repetitive than anyone thought possible.

Millennials’ Burden

Gary hasn’t gotten everything wrong. I’d have to concede, for one, that I did not foresee the current round of inflation. However, I still believe that a catastrophic deleveraging — aka deflation — is the only mechanism through which public debts that long ago ceased to be repayable can be discharged. The inevitable bear market in stocks, postponed by fiscal and credit stimulus of almost unimaginable proportions for far longer than any of us gloom-and-doomers could have imagined, remains the most likely path to debt settlement and a Second Great Depression.

In the meantime, even as prices continue to rise, the quality of consumer goods and services is continuing to fall, deflating our standard of living. Kiosks and keypads are replacing humans everywhere, restaurants are serving cheaper cuts of meat, and telemedicine is being used increasingly to triage healthcare. Granted, Baby Boomers are still getting their artificial hips, knees and stents. But the inability of Millennials and Gen-xers to pay for them is rapidly eroding and will be laid bare in the next recession. ‘Deflation’ in goods and services will be a feature of our lives from now on, no matter what their price.

Which brings me to Tom Luongo‘s April edition of Gold, Goats ‘n Guns. (To read every insightful word of it, click here and subscribe for $125. His geopolitical analysis is in a class by itself. If you prefer provocative, outside-the-box thinking to the unmitigated swill we get from TV’s talking heads and the MSM, this will be money well-spent,) Luongo details how Vladimir Putin has cultivated alliances that are re-shaping the way we pay for energy. This can only erode the U.S. dollar’s hegemony over time. The Russian leader has put his money where his mouth is, selling off Russia’s $100B hoard of Treasury paper and inspiring other sovereign entities, including a few that are not explicitly hostile toward America, to follow suit.

Crap Dollars

This is moving the world toward an economic system in which gold will increasingly supplant dollars as a medium of exchange, says Luongo. I’ve always thought this unlikely, if not impossible, simply because it is so cheap and convenient for energy users to pay for it with debt-based, crap money — i.e., dollars that are effectively in infinite supply. Of course, OPEC and other producers have understood all along that they were being paid in snide for a commodity that is strategically and economically indispensable. But they were able to demand enough snide in return for their real stuff that no Saudi Arabian, Qatari or Kuwaiti prince has ever wanted for a garageful of Lamborghinis in every color of the rainbow.

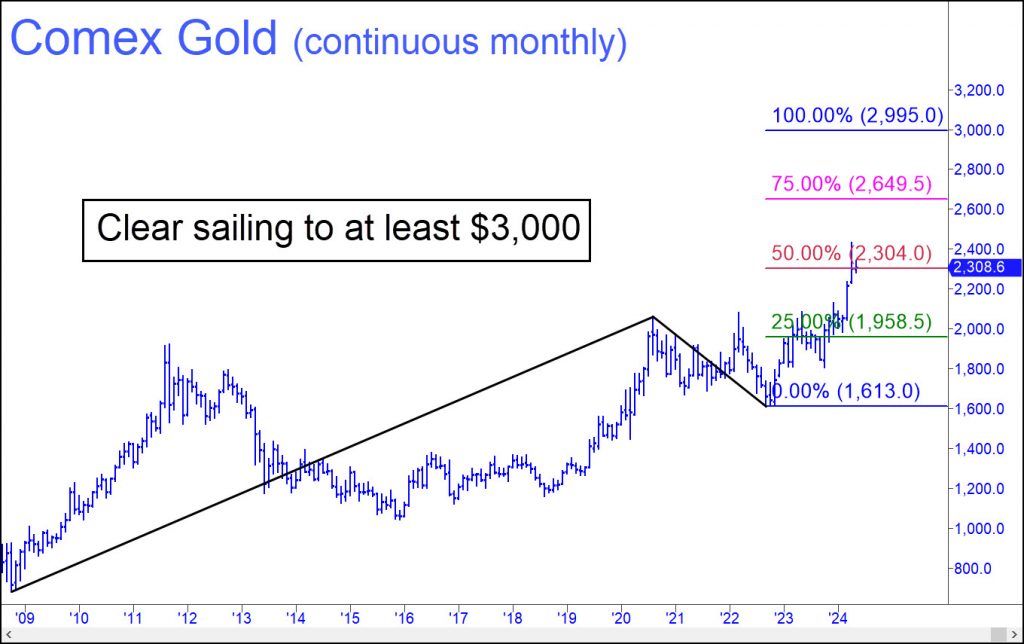

The question is, will today’s profligate users of energy — i.e., all of us — be able to afford it if we have to pay for it with the hardest currency of them all, gold? We’ll see who blinks first in the next recession, when demand for crude falls. Regardless, the strong rise we have seen lately in gold’s price looks certain to continue. It will be boosted by the increasing success of Putin & Friends in creating alternative bullion markets that bypass the criminally rigged, paper-shuffling bourses of Chicago, London, Zurich and Hong Kong.

Paper-Shufflers

An additional question for Tom is whether there can ever be a substitute for the U.S. dollar as the world’s reserve currency. The shaky global banking system is vastly larger than energy markets, aggregating into the quadrillions of dollars, and the crooks who run it are far more numerous and devious than their colleagues in the oil and gas business. These commodities serve as the collateral for the world’s primary business, which is, by far, shuffling paper. Under the circumstances, it’s hard to see how the hyperleveraged derivatives markets that facilitate the conjuring of cosmic amounts of ‘wealth’ from thin air can be replaced without causing the collapse of the existing edifice. De-hypothecation will be the hallmark of the coming deflation, spiking short-term demand for actual dollars so that a currency that is fundamentally crap fleetingly becomes nearly as good as gold.