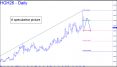

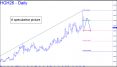

A further fall to the 404.67 target would represent at 27% decline since the stock sputtered out in October at 553.72, just an inch shy of new record highs. The pattern doesn't quite qualify as an ominous, island-reversal top, but it doesn't take a chartist to feel the weight of the dome the stock has traced out over the last nine months. The pattern is simple and obvious, but sufficiently compelling for us to infer that MSFT is far more likely to hit D before C=493.50, if it ever does. This is the fourth most valuable company in the world, behind Nvidia, Google, and Apple, implying that the stock's decline has deflated the global 'wealth effect' by a large amount. See this week's commentary (above) for a further discussion of this. _______ UPDATE (Feb 8): The stock has looked so awful that I am substituting AAPL on the 'touts' list. The chart shows a logical path down to D=376.88. The stock can be 'mechanically' shorted at the red line (p=408.24), stop 418.70. ________ UPDATE (Feb 14): We usually do 'mechanical' shorts at the green line, but I made a rare exception this time, recommending that you get short at the red line (p=480.24) with a 418.70 stop-loss. The trade would have produced a loss of $1024 per round lot. Had we shorted at the green line (x=423.92) as is customary, the trade would have worked out nicely, since the stock made a top at 423.68 just ahead of a so-far plunge of $22.67. The 376.99 downside target remains valid in any case and should be used as a minimum objective for now.

The futures served up such a steaming bucket of slop on Friday that I've projected more of the same as the new week begins. The slop was enough, however, for anyone who followed my post at 8:53 to begin the day with a profit sufficient to cushion whatever else the session's feeble price action brought. Although bulls and bears fought to a draw, I've shaded my bias toward the latter with the 6839.25 target shown. Don't expect the trip there to be as smooth and straightforward as the dotted line I've drawn on the chart.

Can Gold correct the monster, 1660-point rally since October in mere days? It seems doubtful, but we'll be monitoring the 4588.30 target in the chart closely nevertheless, in case it creates a bottom-fishing opportunity. That Fibonacci-based number would represent a 62.5% retracement that overshot the 50% mark on Friday, a day after topping at 5626.80. There is a small chance that the correction has seen its lows, since the 4713.90 closing price was just $2.20 from a downside target derived from a composite monthly chart that goes back to a notable top at 1920.70 recorded in September 2011. _______ UPDATE (Feb 2, 8:08 a.m.): This reverse pattern yields a clearer picture than the earlier one, which focused on the retracement without having the benefit of the robust rally that has occurred overnight. The strong push through p=4725.20 has all but guaranteed the move will reach d=5027.10. It also makes a pullbback to the green line (x=4574.20) a good bet to produce a 'mechanical' profit of at least one level (i.e., $151).

The chart is similar to the one I've drawn in Gold, with a 0.625 retracement serving as a target for Silver's breathtaking correction. It came off a record high on Thursday that missed a 122.215 Hidden Pivot target I'd drum-rolled by a millimeter. Friday's bounce left the futures sitting nearly $3 above the 50% line, but if the correction is going to match Gold's, a retracement to 64.18 is needed. Be prepared to bottom-fish there with a 'camo' trigger, since 64.18 is not going to be on the radar of most traders, derived as it is from a low recorded last April that is idiosyncratic, although not obscure. ______ UPDATE (Feb 2, 7:55 a.m.): I've switched the view, since trying to synch the charts of gold and silver grew confusing. This picture affords 'safe passage' to at least d=91.285, a Hidden Pivot that lies $6.80 above. If it shows little resistance, I will adjust by lowering point 'a' to produce a higher target. In the meantime, a pullback to the green line (x=76.221) can be bought 'mechanically' with a 71.190 stop-loss. That implies more than $5000 of entry risk per contract, so the trade is recommended only to subscribers able to craft a 'camouflage' trigger. _______ UPDATE (Feb 4, 10:59 p.m.): The suggested trade racked up a monster profit of $75,320 per contract for anyone who boarded at 76.221 and exited two days later at my target, 91.285. What happened next should not have surprised subscribers: the futures wafted slightly (47 cents) higher, then fell moments later into a hellish dive that took them all the way back down to, so far, 73.415, a tad below the trade-entry price.

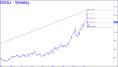

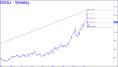

GDXJ's long-term chart differs enough from gold's to allow a more creative approach to targeting this correction. I've masked the A & B coordinates for proprietary reasons, but they indicate a possible further fall to 112.09 before this vehicle can turn around. That Hidden Pivot can serve as a minimum downside projection because of the decisive way the downtrend penetrated p=132.17 on Friday. Any bottom fishing there should use a 'camo' trigger derived from a chart of 60-minute degree or less.

Copper's correction exceeded the midpoint Hidden Pivot support of a pattern I've partially concealed. The overshoot is not sufficient to infer that more slippage to d=5.0095 is a done deal. However, a bounce to the green line (x=6.1896) would set up a moderately attractive 'mechanical' short, stop 6.5830, that presumably would be good for a one-level ride back down to p. If a rally from the green line comes from further below p, that would sweeten the odds for shorts initiated at x.

TLT has done nothing to alleviate a dismal picture on the long-term charts. I am switching the view this week to a chart of long-term Treasury rates which points toward 5.078%. It would be the first time they've traded above the psychologically important 5% level since July, when a peak at 5.077% was recorded. My gut feeling is that anything that close to last May's watershed 5.153% would be tested and exceeded, putting Trump's plans to stimulate the economy in jeopardy. His lips have been pushing hard against the uptrend in yields, but market forces seem to be winning.

Pity the J-school rookies who are paid to explain why the stock market did what it did on a given day. On Thursday, Microsoft shares lost nearly a half-a-trillion dollars of value. But why? Bloomberg's Evening Briefing called it a 'rap on the knuckles' for the company's huge spending on AI projects that seem increasingly unlikely to pay off. But isn't a rap on the knuckles the way nuns used to deal with minor behavioral lapses in young boys? If so, then Microsoft deserved 40 lashes with a rattan cane. Although the story was treated by the hacks who wrote it as a news event, what it portends is nothing short of financial calamity, reported in daily installments. For it is not just Microsoft that has squandered hitherto unimaginable sums on failing AI projects, but a dozen other corporate behemoths, including lunatic-sector (aka 'Magnificent Seven') stalwarts Amazon, Google, Facebook, Nvidia and Tesla. Analysts have projected total global AI spending of $2.6 trillion across all companies and markets in 2026. Here's where the math gets interesting. Microsoft share of those outlays would be an estimated $140 billion. Investors knocked three times that from the company's valuation last week, while also imploding the world's gaseous 'wealth effect' by a rich but still-invisible multiple. If equal punishment were to be inflicted on the companies planning to spend the $2.6 trillion, the haircut would amount to nearly $8 trillion. That is arguably the approximate size of the AI deflation that lies just ahead, and it will activate a black hole that could double or triple losses in other classes of investible assets. Treasury paper will go bounding in the other direction, finally getting some respect as a safe haven. When to Take Heart Granted, neither the math nor the logic is airtight. But the

Copper and a rotating selection of popular symbols will be replacing Bitcoin on this page, although I will continue to provide timely analysis for Bitcoin on demand in the chat room. The chart shows how copper's price has tripled since bottoming just beneath $2 a pound in March 2020, when covid fears seized the world's machinery. 'Doc' Copper has seemingly done its job since in predicting an upswing in global industrial activity. In particular, it included a surge in demand caused by a worldwide push toward renewable energy and electric vehicles, which require a lot of copper for batteries, charging infrastructure and renewable energy systems. However, copper's ascent has nearly reached a hard target at 6.18 a pound that suggests the bull market may have run its course. Does that mean a global recession-or-worse looms? We will not likely know until a recession is well under way. It is coming eventually, but in the meantime, a bull market that has been galloping along for 16 years should command our respect, if not our unquestioning confidence. If an important top is in at 6.1540 (basis the March contract), it would be corroborated by a pullback that decisively exceeds 5.36. A somewhat higher top would require an adjustment in that number, a Hidden Pivot, so stay tuned.

The mindless herd breathed a collective sigh of relief over the tariff tizzy's latest cliffhanger, celebrating its resolution with a short squeeze up their own wazoos that played out mostly on a single day, Wednesday. The spree left the futures just shy of a 6984.00 target that is nothing special, although its decisive breach would suggest a possible breakout above the range that has asphyxiated the S&Ps since Halloween. More likely is a drop back into the valley, whose floor lies as much as 1400 points below. The 6984.00 target is shortable, but you could also attempt a ride to it, since it is all but certain to be reached. _______ UPDATE (Jan 27, 9:28 p.m.): ES is breaking out, as painful as it is for me to believe. See my comments in the chat room.