I'd expected a modest pop to the 24.08 target of a reverse pattern to start the week. Instead, March Silver stumbled as it emerged from the gate, disappointing bulls yet again and providing yet more evidence that the bull market from hell is on its own time. My hunch is that the target will be achieved, but only after the futures have come down to the 22.385 target of the small rABC pattern shown. This calls for bottom-fishing with a 'camouflage' trigger, meaning an abcd pattern of small degree (the 15-minute chart should do).

Rick Ackerman

ESH24 – March E-Mini S&Ps (Last:5094.75)

– Posted in: Current Touts Free Rick's Picks

The futures rallied last week to within a hair of the 5128.50 Hidden Pivot target sent out to you last Sunday. The forecast came with an explicit, high-confidence recommendation to get long if the uptrend pulled back to the green line (x=4984.50). This it did on Tuesday, subsequently producing a profit of as much as $7,200 per contract for anyone who did the trade. I followed up on Friday afternoon with a suggestion to buy SPY 1 March 498 puts. (See my chat room link to the gnarly chart that informed this decision. ) Most subscribers were able to buy them within a penny of their intraday low, 0.37, so we'll have a horse in the race when index futures resume trading on Sunday.

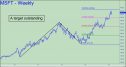

MSFT – Microsoft (Last:410.32)

– Posted in: Current Touts Free Rick's Picks

The hourly chart is mildly bearish, albeit with no hint of a major top. That's why I've reproduced the weekly chart, with its compelling target at 430.58, as a reminder of how close the stock is to hitting a resistance that it is unlikely to penetrate, much less brush aside. It will have help putting in a top from a few other lunatic-sector faves, including CMG and NFLX, which have maxed out their respective weekly charts. If MSFT struggles to push above Friday's 412.06 high for a day or two, that would leave it vulnerable to a 50-point fall over the near term. We won't attempt to short it, though, unless it pops to 430, so stay tuned.

The Fallacy of the Wall of Worry

– Posted in: Free Rick's Picks The Morning LineSo much for the wall of worry! Optimists and visionaries supposedly climb it while ignoring troublesome signs that leave most investors on the sidelines, paralyzed with fear. Last week, as soaring shares of Nvidia tugged stocks higher around the world, speculators swarmed the wall like cockroaches gorging themselves on dried beer, glue and animal feces. Do insects ever pause to worry? More likely is that even the dark shadow of a size 14 shoe descending on their wretched banquet would not quiet the feverish din of a hundred thousand mandibles crunching away. And so it is these days on Wall Street, scene of an epic wallow that is far removed not just from worry, but from reality. The so-called Magnificent Seven -- we have always referred to these stocks, more appropriately, as the Lunatic Sector -- all by themselves created more than a trillion dollars of 'wealth' in just the last week or so. This occurred when stocks took volumeless leaps on earnings announcements whose details, whether bullish or bearish, were of scant concern. No one maintains any longer that this is rational behavior. But leave it to Wall Street's hype machine to tell us that earnings eventually will catch up to the craziness. Really? Celebrate This! The megastocks have gone vertical at a particularly unsettling time. Commercial real estate is collapsing, government is doing most of the hiring, brutal price increases for nearly everything have crushed middle-class purchasing power; and borrowers, led by the U.S. Treasury, will need to refinance more than eight trillion of debt this year at significantly higher rates. To make matters worse, inflation is poised to take off again, in part because of higher costs incurred by shippers avoiding Houthi missiles in the Suez. Under the circumstances, it is far more likely that the next

CLJ24 – April Crude (Last:76.57)

– Posted in: Current Touts Free Rick's Picks

Crude is the most agitated trading vehicle I track, but paradoxically the easiest to trade. We can practically count on every tradable price reversal to come from within a tick or two of an in-your-face-obvious prior high or low -- i.e., from smack-dab-in-the-middle of a 'discomfort zone'. The pattern shown has a rally target at 80.30, and we know from experience that the political powers that be and their lackeys will be there to impede the uptrend, lest gasoline prices become problematical for voters nine months ahead of the election. The pattern is also an inch from triggering a textbook 'mechanical' buy at the green line. Watch it develop if you are bored. _______ UPDATE (Feb 23): The green line (x=76.71) could have been used to make as much as $2,200 per contract with little difficulty, since the futures made a nearly two-level move after dipping slightly below the line on Wednesday morning. A subscriber reported having used UCO to do the trade. Here's the chart. The 80.30 target given above remains valid.

ESH24 – March E-Mini S&Ps (Last:5014,50)

– Posted in: Current Touts Rick's Picks

Bulls were in charge when the week ended, having clawed their way back to within an inch of new record highs. Option expirations slowed the ascent, since many traders held calls at the higher strikes that had prevailed before stocks plunged on Tuesday because of unsettling inflation news. Although the futures finished the day down 32 points, it took gumption for bulls to pull the lunatic stocks out of a nosedive that began to gain momentum just minutes into the session. Look for the rally to continue to the 5128.50 target of the pattern shown, and don't pass up the opportunity to bottom-fish 'mechanically' if a correction should bring the March contract down to the green line (x=4984.50).

GDXJ – Junior Gold Miner ETF (Last:32.43)

– Posted in: Current Touts Free Rick's Picks

By now, we've come to expect little of rallies in this vehicle, and so last week's so-far modest bounce off a secondary Hidden Pivot at 30.68 is unlikely to arouse much interest. It could run all the way up to the green line (x=36.77) and still be nothing more than a promising short. Thereafter, or perhaps before then, look for GDXJ to turn south, bound for the 27.63 target. The good news is that the pattern is a pretty one likely to produce a targeted low we can trust.

MSFT – Microsoft (Last:404.06)

– Posted in: Current Touts Free Rick's Picks

MSFT has replaced AAPL on the list for the time being, since its chart is more fun to look at. This is notwithstanding the tonnage that has been distributed between 403 and 410 over the last three weeks. It is real and it is heavy, but we know that DaBoyz are capable of rendering it insubstantial with a short-squeeze when conditions are right. My hunch is that they will still have to take the stock down by at least $3-$4 before they can set up the volumeless leap into a sunny-and-mild wafting zone above $410. We are still focused on a target at 430.58 (or possibly 437, which comes from the weekly chart) as the place where this aging bull market will seven out.

GCJ24 – April Gold (Last:2049.40)

– Posted in: Current Touts Rick's Picks

The pattern shown, with a 2056.30 rally target, is not particularly bullish, but it looks serviceable for trading. A presumably corrective rally stalled Friday at 2026.40, the midpoint resistance, but any headway above it when the new week begins would imply the target is likely to be reached. A 'mechanical' buy at the green line looks promising, but I'd suggest that you act only if the pullback has come from above p=2026.40, especially if it is exceeded decisively. _______ UPDATE (Feb 23): Last week's modest rally fell a few dollars shy of the 2056.30 target flagged above, but you can expect it to be reached within the next couple of days. It is shortable via a tight 'reverse pattern' for subscribers who are familiar with this tactic. The pattern can also be used for 'mechanical' buying at either p or x if the futures favor us with a swoon,

SIH24 – March Silver (Last:23.475)

– Posted in: Current Touts Rick's Picks

Friday's blast through p=23.03 clinched more upside to at least 24.08, the unexciting target of the pattern shown. That would amount to a rally of just 60 cents, but if the futures thrust past this 'hidden resistance', we could look for a test of the peak at 24.895 recorded on December 22. It's too early to start counting our chickens, especially given the way the futures have underperformed since early December. But our bias will be bullish for now. Since the last correction would have trashed a 'mechanical' bid at the green line, I won't suggest attempting to buy there if the opportunity presents itself.