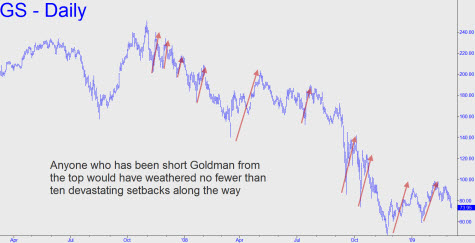

Why is it that the juiciest shorts are all but un-shortable? The shares of Goldman Sachs, for instance. We predicted here a while back that the stock would eventually trade below $30, a 67 percent plunge from its then price of around $90. We were so sure of this that we promised to don a grass skirt and dance the hula in Times Square in the middle of winter if we were wrong. We’re still sure of it: Goldman shares are headed for disaaster. So why not simply short the stock in size, forget about it, then come back in two years to collect the huge profit that would be sitting in our trading account? The answer lies in the chart below. If you consider it as a whole, it’s plain to see that Goldman, like so many other financial stocks, has been devastated by the bear market begun eighteen months ago. It has dropped 81 percent so far from high to low.

But look at how the decline has played out. If you had had steel-trap nerves and the genius to short a thousand shares when the stock spiked to an all-time of $250 in October 2007, you’d undoubtedly have been giddy over the $50,000 profit you’d earned when GS subsequently fell to $200 over the next six trading days. But four days later, 80 percent of your gains would have been wiped out when Goldman shot up to $240.

Leveraging the Death Dive

The roller-coaster ride continued until last February, when the stock took its steepest plunge so far, a 33 percent drop between February 1 and March 17. To have caught this death dive, however, especially the wickedly rewarding first two days when GS fell from $209 to $189, you’d need to have survived impalement by the short-squeeze that had preceded it — a nine-day thrust that saw the stock shoot up 20 percent in a little more than a week. And did we mention that you had only a few hours to cover at the death dive’s $140 low, since that was a “key reversal day” that saw the stock trampoline back up to $185 in mere days?

We have all heard stories about traders who made their fortunes by riding a bull or bear market all the way. But as this chart implies, it can only be done if you are willing to ignore huge swings against you the whole way up or down. Study the chart and you will see that for each $10 you might have made holding a short position from one peak down to the next, you would have weathered swings against you that averaged around $40. And even if you had been so stupid as to allow that to occur, and quite a few times, the gains would not have come pleasurably, to put it mildly, since the stock’s big down days were as rare as four-leaf clovers.

So beware of the trader who brags that he made a killing surfing a big wave, since he could only have done so by taking inordinate risks. You could lay odds that sooner or later, unless he has retired or found another game, he’s going to drown.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

GS Trading Corp went from a 100% premium at 222.50 in 1929 to 1.75 when Walter Sachs was called to testify before a Senate Committee for Ponzi-like behaviour.

GS also had the distinction of issuing most of $80 M in Commercial Paper for bankrupt Penn Central,m perhaps one reason they decided to colonize and con\trol as many financial institutions as possible, including the US Treasury.

GS had its share of market miscues as market leader, including derivatives that may have required WEB et al to put up $5 B and taxpayers more in TARP.

One reason for GS stock volatility may be only 12% of the shares are in public hands… Regards*Rich

PS Very good day for US, climbing a wall of skepticism & worry?

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID3251493