“Gold Is Still a Lousy Investment,” proclaimed a Wall Street Journal headline over the weekend. Does this sound like sour grapes, or what? It ran atop a feature by Dave Kansas in weekend editions. Kansas, who used to work for Jim Cramer, is currently European markets editor for the Journal. We wonder what could have possessed him at this moment to do a hit-job on gold, since it is one of the only investment assets to survive the global asset crash of the last several years. It is also one of just a small handful of investment assets that is still worth more than in 1999. Much more, actually. And most recently, no matter what kind of news has rattled investors, gold has effortlessly sustained cruising altitude near $1000 an ounce.

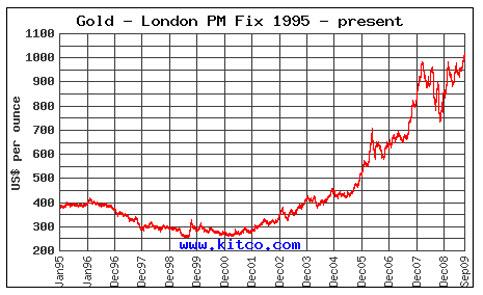

We also wonder how far back Kansas intended to take us when he wrote that gold is “still” a lousy investment. The Kitco chart above shows that you’d have to go back more than a decade, to the mid-1990s, to find a time when holders of bullion assets could have lost serious money. Since then, however, anyone who has bought gold would have nothing to complain about. Far from it, since investors aboard early in the bull market could easily have doubled or even tripled their initial stake. Moreover, there are almost no losers in gold right now, since bullion’s price was higher than the current $1003 for only a few weeks back in March of 2008. Maybe that’s when Kansas took the plunge?

‘Dead Money’

So what does he recommend as an alternative? TIPS – Treasury inflation-protected securities. He notes that gold investments were “dead money” for decades, but that it’s highly unlikely TIPS would suffer the same fate. Kansas, at 42, isn’t old enough to remember a time, during the 1970s inflation, when bonds were much worse than “dead money”. They were toxic, in fact, and many investors who had always viewed bonds as “safe” experienced devastating portfolio losses. Kansas also seems not to know that gold has performed better in deflationary times than during inflationary periods.

Spuriously, he traces gold’s ups and downs over the last 40 years, concluding that although “investing in gold may sound simple…it’s anything but.” If Kansas has a simpler way for investors to hedge the risks of a global economic collapse that seems almost unavoidable, we’d be interested in hearing about it. Meanwhile, putting the knock on gold as it consolidates near $1000 is the worst investment advice we’ve heard since we last heard from Abbe Cohen and Larry Kudlow.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Good for you, cosmo. If we, as a country, had honest money instead of the FED’s fiat maney system we have now, we’d all be like you.

Of course, then, the gov’t would have no control over us at all. A truly free and independent people is not possible without honest money e.g gold and silver. That’s why the Constitution requires only gold and silver to be money. How far we have fallen.

Rather than laugh, I applaud you. Now teach others too.

Chris