U.S. stocks rose yesterday, so it would appear that Dubai’s reported troubles were overblown. Or were they? Initially, stock markets around the world sold off heavily on news that Dubai’s holding company, mega-developer Dubai World, was about to go under owing nearly $60 billion. When the story hit the news wires — unsurprisingly, on Thanksgiving Day — it sent Asian and European markets into a steep dive. U.S. stocks looked as though they would follow suit when index futures began to trade on virtual markets Thursday night. The electronic Dow contract, for one, was predicting that the Industrial Average would plummet more than 300 points at the bell. When the dust had settled, however, the day turned out better than one might have expected. The blue chip average, which had opened about 230 points lower, clawed its way back up to 10310 by day’s end. The net loss was a less-than-calamitous 150 points. How could it have been any worse than that when the world’s banks would rather shovel their liquidity at stocks and Treasury paper than make loans to businesses that in any case are not eager to borrow?

Although weekend business reports were filled with dread about what might happen next, traders needn’t have worried. When the New York Stock Exchange opened on Monday morning, the market was as calm as could be — as though Dubai World’s problems had simply melted away. Stocks opened almost exactly where they’d finished the week on Friday, then spent the rest of the day in the trance-inducing oscillations of a tight range.

A Magnetic Field

Things were too calm, really, since the fallout from Dubai has yet to be determined – or perhaps imagined, since the links between large borrowers these days are as tenuous and arcane as the emanations of a magnetic field. Who can say what will follow in the wake of Dubai World’s collapse? With crude-oil prices pushing $80 a barrel, one would have thought there was enough money in that part of the world to paper over the problems of one real estate developer, even a very large one. But perhaps not.

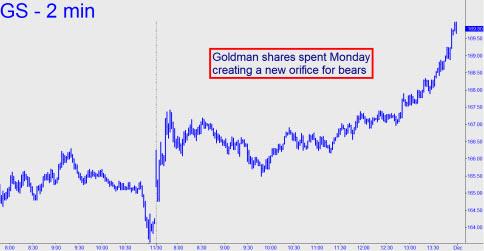

In the meantime, the dervishes who control the shares of our market bellwether, Goldman Sachs, lost no time carving new orifices in those who had gone home short over the weekend. The stock opened higher on a gap, then cruised to a $5.34 gain on the day – its best showing in weeks. Would it be churlish to point out that in its bear-rally heyday just a few months ago, Goldman would have been up by twice that? The rally looked likely to continue into Tuesday nonetheless, but we doubt it will get much farther. And why should it, on fresh evidence that the global financial system is poised for another pass through the wringer? The timing of this rally was perfect to exact maximum pain from shorts and to fool the brainless twits who bring us the news each day into believing that perhaps this Dubai thing won’t amount to much. Have they learned nothing in the fourteen months since Lehman Brothers’ collapse? Apparently not.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

just a point missed by most, the Dubai announcement occurred before the business closing for Eid-ul-Adha – a major Muslim holiday period . it was not timed for western purposes, or Thanksgiving.

the timing was curious because it precluded rescue actions from UAE or Abu Dhabi for many days because of the holiday.

this is the issue i do not understand.