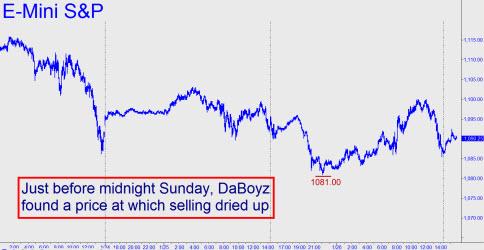

Yesterday’s failed rally demonstrated once again that short-covering remains the only force capable of pushing stocks higher on a given day. It also showed that there are no longer enough nervous bears around to drive the market into a sustainable uptrend. In this latest show of false strength, the Dow Industrials achieved maximum loft about midway into Tuesday’s session, when they were up about 100 points. But the set-up for this bull-less rally came the night before. As is nearly always the case, off-hours activity in the electronic index futures was used to catalyze buying urgency ahead of the opening. Notice in the chart below how the E-Mini S&P futures were actually down significantly Monday night. Shortly after midnight EST, eight hours after night trading began, the E-Mini S&P hit a low of 1081.00, off 11.25 points from the previous day’s settlement price. At that point, the futures were predicting the Industrial Average would open down almost 100 points on Tuesday.

Lo, over the next eight hours, in the dead of the New York Stock Exchange’s night, they recouped all of the lost ground before dropping back slightly just ahead of the opening bell. Bears must have been pretty nervous at that point, since the futures had been trending higher for nearly ten hours. The short-covering panic that followed caused the E-Mini S&P to rally 10 points in the space of an hour, and the Dow to surge 84 points. Stocks then pulled back a bit to get second wind, which set up a turgid, 80-point rally over the next two-and-a-half hours.

This trick has been used by DaBoyz so many times it’s a wonder it still works. The ploy’s success depends on their finding a price level Sunday night where selling exhausts itself. Once this has been determined and the last nervous Nellies have been shaken out, shares have nowhere to go but up. Occasionally the tactic backfires when night-time selling picks up momentum because of bearish news on the tape. The NYSE specialists, having bought stock at successively lower prices throughout the night, are greeted by an avalanche of market orders on the opening. But usually, the tactic of shaking out weak sellers in off-hours trading produces a floor beneath which the broad averages are unlikely to fall, save on those extremely rare days when bears romp from bell to bell.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Three feet of powder sounds much more interesting , try Highlands bowl sometime, the North woods are Nirvana.