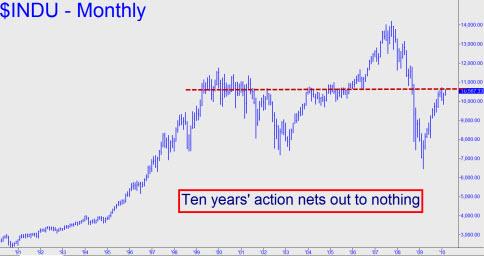

Readers got pretty stirred up the other day after we published a think-piece by Sinophile Mario Cavolo asserting that the world would muddle through its financial crisis without experiencing a catastrophic collapse. Although we disagree and expect a one-two punch of deflation/hyperinflation to put the global economy and financial system into a deep coma for at least a few years, we’d have to concede that a more boring outcome is at least possible. As much might be inferred from the chart below, which shows price action in the Dow Industrials going back 20 years.

The first thing to notice is that the Dow is currently trading near the exact middle of the last ten years’ powerful ups and downs. Not exactly horrific, considering the financial system is immersed in its deepest crisis since the Great Depression and the economy remains frozen. Referring to the chart, if you draw a horizontal line passing through as many price bars as possible during that period, it would just nip the top of yesterday’s high. In fact, the blue chip average has done absolutely nothing since the late 1990s if inflation is ignored. And if it is not ignored, you can see what a losing game the stock market has been for the average investor. Could it have been just a few short years ago that investors told pollsters they expected to reap annual gains averaging 28 percent until the end of their days? Warren Buffet probably wishes he’d done half that well over the last few years.

Boring Resolution Unlikely

Regarding the possibility of a boring resolution to America’s, and the world’s, towering debt problems, we think the odds are heavily against it. So egregious are the lies that currently sustain our economic system that muddling through seems quite impossible. Where the U.S. is concerned, governments at all levels are either bankrupt or very nearly so, Social Security, Medicare, public and private pensions, and the banking system are sustained by egregious lies; the stock market, by a torrent of funny money. The national debt is $14.3 trillion dollars and climbing rapidly, and…well, you can see that the hole is simply too deep to allow an escape. Nor will Europe. The fact that the dollar has been “strong” relative to the euro tells you how serious Europe’s problems are. And although Asia is likely to be the first to emerge from whatever bog the West drags them into, China, Japan and India will not avert the disaster that looms before their trading partners.

In the meantime, anyone who draws solace from the stock market’s relative calmness in these times of extreme economic adversity is in for a rude awakening. Wall Street exists in a warp that separates it from the economic realities of daily life. Indeed, judging the economy’s health on the basis of the Dow’s performance is like taking encouragement from the placid alpha waves that ripple across the screen of a brain-dead patient’s life support system.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick, belatedly here:

Should these observations of patterns not be made on log-charts?

Just wondering…