We’re so bullish on the stock market right now that we can barely look ourself in the mirror. Having hated the Mother of All Bear Rallies since it began nearly fourteen months ago, we’ve tried to make our peace with it by projecting higher prices the whole way up; by trading from the long side whenever a fat opportunity presented itself; and – this is the fun part – by shorting every upthrust that kissed a promising short-term target. Check the Rick’s Picks archive if you don’t think this works. It’s fun, as we said, even though it would be nice if just once the pullback following a rally lasted for longer than a measly day or two.

Hope springs eternal, though, and that’s why we’d been looking forward to a potentially important top in the E-Mini S&Ps just a few points above yesterday’s 1216.75 high. On further inspection, however, although our target remains shortable, we determined that the odds of the broad averages taking a flying dive into hell after hitting this target seem remote. There are good technical reasons for this, some relating directly to the E-Mini

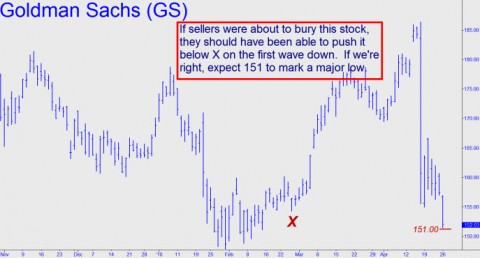

S&P’s longer-term charts. But one need only look at Goldman’s daily chart to see where the problem lies. Recall that just ten days ago, when the firm was accused by the SEC of flim-flamming investors, the stock went into a freefall, shedding 31 points that day. That represented about a sixth of Goldman’s total capitalization, and it must have scared hell out of anyone on the wrong side of the move. It would also put a lot of weight on the stock market as a whole if it continues.

A Goldman Shakedown?

But when you apply Hidden Pivot analysis, the move looks like it was just a fake-out – a ruse by Smart Money to shake down the stock so that They can scoop up millions of shares at fire-sale prices. Basically, if the selling were serious, the first wave of it would have pushed the stock beneath the teeny prior low at 154.32. Since it didn’t, we are given to infer that the selling lacks real guts. Moreover, since the guys doing the scooping are never wrong, it’s probably safe to say that Goldman is not going to get dinged too badly as a result of the civil fraud suit brought against them by the SEC.

Concerning the odds of GS shares reversing with a vengeance today or tomorrow, we’ll know more after we’ve seen the stock interact with 151.00, a Hidden Pivot midpoint support. That’s where we think GS is going to make a bullish turn, and it would be even more bullish if the turn comes from somewhere above the support. As of yesterday, GS had gone as low as 151.52, so the jury is still out. Since we never want to chisel these predictions in stone, we’ll allow for the possibility that Goldman shares are indeed headed lower – much lower – and that perhaps the company is about to get sued into oblivion by every city, county and state and sovereign government with whom it has done business. If so, we should expect to see GS close below 151.00, since that would imply further slippage over the near term to as low as 135.30. One final note: We’d be buyers ourselves down there, although our very long-term forecast still calls for a collapse to under $30 a share.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Oh dear, mega bulllish one day, cautious/barish the next. Cant trade or invest on that basis. Its a farce!

Me, another moonshot to the may 20 top date, after a correction into next week, and then after the may date, get the f&^k out!

&&&&&&

Nothing like an unequivocal call, Tor. If it turns out you’ve hit the bullseye — and nothing less will do, since there are bound to be a hundred of us gurus inside the ‘8’ ring on this one — please do remind us of this post. RA