Leave it to the Wall Street Journal to wax enthusiastic over a perpetual-motion machine for the U.S. economy that in reality can no more exist than a unicorn. Here’s the headline, proffered by the Journal under the dubious title “Economic insight and analysis” and written by one Alex Frangos: “Don’t Worry About China – Japan Will Finance U.S. Debt”. Frangos notes that Japan has stepped up its buying of U.S. Treasurys, as indeed it has, in order to slow the rise of its own currency. This is a crucial task for Japan Inc., since even a relatively small increase in the value of the yen can wipe out a competitive advantage that its exporters have worked hard for decades to achieve. The damage has already occurred to a significant extent, since the yen has rallied 15 percent since May. However, Japan’s most recent interventions have been so aggressive as to suggest the goal is to scare yen buyers out of the market for a long while. We have our doubts this tactic can succeed, especially since China has become one of the yen’s biggest buyers, but for the time being it has driven the yen sharply lower.

The crazy idea here is not merely that stepped-up Japanese purchases of U.S. Treasury paper will somehow take up the slack now that China has begun to aggressively diversify its $2.5 trillion reserves away from the dollar. What Frangos is suggesting is that China’s move out of dollars will stir up strong new demand for greenbacks among China’s major trading partners, all of whom will supposedly be more eager than ever to keep their currencies cheap relative to the dollar. Under this scenario, countries such as South Korea, for one, will be so vigilant about preventing the Chinese from gaining a further currency edge that they will ultimately buy even more U.S. Treasury paper than China was buying, driving the dollar higher.

Boldly Stupid

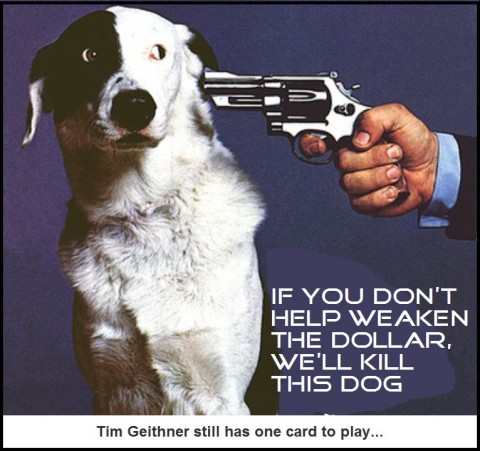

To the extent this prediction could become self-fulfilling, at least for a short while, it may drive Tim Geithner to apoplexy. Lately, the Treasury Secretary has been working overtime to promote the boldly stupid idea — universally believed by the press and by many economists, evidently – that a stronger yuan would help U.S. exports sufficiently to rejuvenate our economy. As plausible as this may sound, it ignores the fact that, apart from Hollywood movies, Boeing aircraft and Caterpillar tractors, “financial products” now more or less shunned by the world have long been America’s biggest export. If Geithner now must widen his jawboning campaign to include South Korea and the other Asian tigers, his exhortations are going to sound even more pathetic, since the U.S. will find itself moving further out on the financial ledge, telling our creditors in effect that we’ll jump if they don’t do as we ask.

Whatever happens, it’s going to be a lose-lose situation for the whole world, since the financial shell game is many orders of magnitude larger than real trade in goods and services. By holding the global economy hostage to currency shenanigans, the central banks risk subjecting actual commerce to something like the “flash crash” that occurred on Wall Street back in May. China would have more to lose than anyone, given the size of the country’s dollar reserves. They undoubtedly can see a disaster taking shape but know they cannot escape it without further destabilizing the markets. However, it must be comforting to them to know that, alone among nations, China can survive a trillion-dollar hit and someday come roaring back – as it eventually will.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box.)

Most analysts can only focus on stocks, bonds and cash.

They ignore physical gold and silver to their own peril. Oh sure they will tell you to buy the ETFs and gold and silver stocks….(because they earn commissisons).

The bigger risk for all stock holders is the failure of the clearing agency. It’s all in one place now. How do you get your funds even if you have sold? That entity could implode and you will have a lot of missing electronic

numbers. I limit my cash exposure in banks and credit unions and in addition I don’t have that many stocks.

Oh yes…if they mention gold they suggest 5-10% as insurance! My portfolio is loaded the other way 90-95% physicals and the rest in speculative items like cash and stocks!

w

P.S. A long time ago I let the U.S. Gold Bullion Exchange (big ads in WSJ) take my money in exchange for a 1,000 ounce silver bar which turned out to be a “woody”. The $4500 had grown to $8400 and they went bankrupt. Got 29 months in jail and out not long afterwards for good behavior. (Not even banned from pulling another Ponzi)!!!! Oh I did get a nice “tax loss” for my efforts but I didn’t have to worry about storing the bar did I?