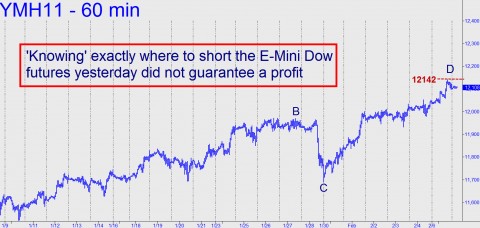

We sometimes forget that trading can be more humbling, even, than golf. Who could have imagined we’d predict the Dow’s intraday high within a point, only to blow the short trade we’d advised from that high? That’s what happened, mainly because, when the trade started to go our way, we lowered the stop-loss by a hair to all but eliminate the theoretical possibility of even a small loss. Here’s the way it played out: Anticipating a 100-point rally in the Dow on Monday, we put out the following recommendation to subscribers Sunday night, referencing the March E-Mini Dow contract: “The futures look bound most immediately for 12142, a Hidden Pivot shown in the chart. The target looks not only like a high-odds bet as a minimum upside price objective, but also a good place to attempt shorting with a stop-loss as tight as 12151.” The chart we used to project the high is shown below, and although for proprietary reasons we have not labeled all of the coordinates employed to predict the exact top, you can learn how to do this nifty little parlor trick yourself by taking the upcoming, six-hour Hidden Pivot webinar. For further information, including a detailed description of the Hidden Pivot Method, click here.

Getting back to yesterday’s price action, the Mini-Dow futures got off to the strong start we’d expected, and so we opened up an impromptu virtual meeting room for Rick’s Picks subscribers to give them precise advice in real time for getting short at the target. At the time, the Mini-Dow contract had traded as high as 12130, getting within 11 point of the target. They tiptoed still higher, to 12141 – a point beneath the target, and that’s where we “declared” ourselves short. The entry was not merely hypothetical, however, since someone in the chat room admitted to having jumped ahead of our 12142 offer with one of his own at 12141.

Missed Coffee Break

From that point on, the trade should have been managed mechanically to keep risk and reward in a 1:3 relationship. This implies that we needed the trade to go in-the-black by at least 30 points before we took a partial profit or instituted a trailing stop for a single-contract position. That’s because we had risked 10 points on the initial stop-loss. So far so good. A coffee break at that point would have been just the thing, since we’d probably have parked an automated order to stop us out of the trade if the futures poked above the day’s so-far peak at 12141. Instead, to save a few pennies and ensure we would lose no money on the trade, even after commissions, if the futures returned to the day’s highs, we brought the stop-loss down to 12141. The predictable result was that the futures made one last head-fake to…12141; then they fell for the remainder of the session. They were still falling, albeit gently, in after-hours trading around 10 p.m. EST.

The lesson here is that, if nothing changes, you should stick with your original game plan rather than second-guess your mechanically-determined stops. A good way to avoid having Mr. Market screw with your head, as he did ours, is to avoid studying his behavior too intently. Never look the bastard in the eye.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

i try to always remember

“the market will remain illogical for longer than i can remain solvent ” and

“better to be lucky than good”

and just accept stopped out and move on whatever the luck . Whats gone is gone,the best traders i know and have known who now enjoy retirement on a private island or yacht were just relentless in their participation and discipline

if trailing stops moved to ensure flat p/l participation , if the trade originator method is correct you will have many more winners than unfortunate stop outs