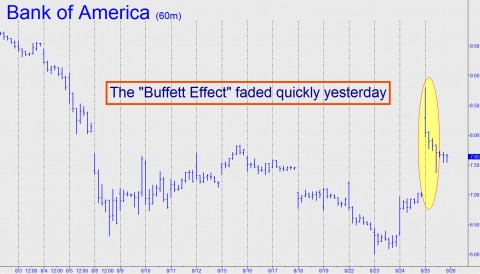

Placing one’s chips on the “Don’t Pass” line when Warren Buffett holds the dice may seem ill-advised, but we’re not so sure about that $5 billion bet he just made on Bank of America. The news media inferred with all its might that it was a vote of confidence — not only in B of A, but in the U.S. banking system. Yeah, well, maybe. But it would be just like Buffett to make the kind of deal that will return all of his capital come hell or high water while allowing him to reap a windfall if the bank should rise from the grave. In the meantime, the six percent dividend he’ll be collecting each year is a lot better than most hedge funds have been doing lately. Buffett could also become the bank’s biggest shareholder if he is able to exercise warrants to purchase 700 million shares of common stock for $7.14 a share over the next ten years. Had he been able to do so yesterday, it would have been quite a score – worth about $357 million in instant profits — since mere news of the deal caused B of A to gap up to $8.80 a share on the NYSE opening. The stock had settled the night before at $6.99 after trading as low as $6.01 earlier in the week. The hysterical price leap was undoubtedly due to short covering, since it’s hard to imagine anyone but bears caught in a deadly squeeze paying a 47% premium for the stock just because Buffett had signed on.

For all we know, he shares our opinion that B of A, like all of the other money center banks, could conceivably fail. All that’s needed to make it happen, as Buffett must know, is for confidence in Federal Reserve notes – i.e., the stuff we carry in our wallets – to fail. Is that day coming? No one can say for certain, but it seems no worse than an even-money bet to us right now. More immediately, though, look for the press to shill the supposed symbolism of Buffett’s banking play. “Warren Buffett comes to the rescue again,” was how ABC news led the story, while MSNBC anchor Brian Williams fatuously described the Sage of Omaha as “the one man rich enough, and influential enough, to save a bank.” As indeed he may have, even if just temporarily. It was only a couple of days ago that B of A stock nearly slipped below $6 for the first time in decades.

Now, How to Grow?

But for Buffett to realize a fat capital gain, Bank of America will need to figure out how to grow its business. It was easy enough for the big banks to fake good health a few years ago, when the Fed allowed them to dump their toxic loans into the still-nebulous limbo of the central bank’s digital vault. But if there is a sound way to actually grow banking business in the midst of the current real estate depression, we can’t imagine what it would be. Buffett himself was not pressed for his thoughts on this, but we’d be interested to hear them. Surely he has some good ideas, right? In the meantime, the news media accepted at face value Buffett’s white lie that he did the deal because B of A is a “strong, well-led company.” If that is a fact, then investors who have allowed the stock to fall from a high of $55 toward the zero axis in recent months have yet to discover it.

From a technical standpoint, we have B of A shares falling below zero. While this is not technically possible, it is the same result we got a few years ago when we performed a similar analysis on the shares of Bear Stearns and Lehman Bros before they crashed. Incidentally, if you want to follow our analysis of B of A and other stocks, as weupdated round-the-clock, consider taking a free trial subscription to Rick’s Picks. It will give you access not only to timely analysis and detailed trading recommendations, but to a 24/7 chat room that draws savvy traders from around the world.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

BofA is such an abysmally run company. If you’re not familiar with the particulars of just how stupid they are, read Crash of the Titans by Greg Farrell. He chronicles the Merrill deal in intricate detail from both the BofA and Merrill perspectives. Reads like a novel.

How do buffoons like Stan O’Neal and Ken Lewis get to be CEOs of major corporations?