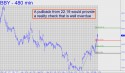

I turned quite bullish on the stock in mid-January, when it was trading around $14. My inspiration was part technical, but the other part was an article in Wired magazine that suggested the company had some good ideas for turning things around. The guy who brought those ideas — from Starbucks — departed after only a couple of months, but it appears that BBY has taken his game plan to heart. That said, the stock has gotten considerably ahead of results and looks like it will be an opportune short at or near the 22.19 target shown. My original target was 19.86, but with that Hidden Pivot now choking on dust, I simply relocated the B-C coordinates to a higher bracket. Long-term investors should consider covered writes if and when the stock approaches 22.19, but that number can also be shorted using camouflage if you’ve got no position. _______ UPDATE (March 18, 11:10 .m. EDT): After five days of relentless climbing, BBY has hit a recovery high today, so far, of 22.21 — two cents above the target that was disseminated when the stock was trading 10% lower. Longs can do covered writes here by selling April 22 calls for 1.03 or better. Officially we are short 400 shares from 22.19, stop 22.31.On an o-c-o basis, cover half the position at 21.94. _______ UPDATE (11:35 a.m.): Off a so-far correction low of 21.92, we’ve covered half the position, leaving us short 200 shares with an adjusted cost basis of 22.44. Retain the 22.31 stop-loss for the shares that remain, lowering it to 22.21 if 21.76 is touched. _______ UPDATE (March 19, 12:55 p.m. EDT): The stock bottomed at exactly 22.76, so we covered the remainder of our short position at 22.21. The trade was a scratch. It seems most unlikely to me that BBY is going to surpass such a clear Hidden Pivot target by much, but we’ve closed out the position nonetheless, sticking with our discipline.

I turned quite bullish on the stock in mid-January, when it was trading around $14. My inspiration was part technical, but the other part was an article in Wired magazine that suggested the company had some good ideas for turning things around. The guy who brought those ideas — from Starbucks — departed after only a couple of months, but it appears that BBY has taken his game plan to heart. That said, the stock has gotten considerably ahead of results and looks like it will be an opportune short at or near the 22.19 target shown. My original target was 19.86, but with that Hidden Pivot now choking on dust, I simply relocated the B-C coordinates to a higher bracket. Long-term investors should consider covered writes if and when the stock approaches 22.19, but that number can also be shorted using camouflage if you’ve got no position. _______ UPDATE (March 18, 11:10 .m. EDT): After five days of relentless climbing, BBY has hit a recovery high today, so far, of 22.21 — two cents above the target that was disseminated when the stock was trading 10% lower. Longs can do covered writes here by selling April 22 calls for 1.03 or better. Officially we are short 400 shares from 22.19, stop 22.31.On an o-c-o basis, cover half the position at 21.94. _______ UPDATE (11:35 a.m.): Off a so-far correction low of 21.92, we’ve covered half the position, leaving us short 200 shares with an adjusted cost basis of 22.44. Retain the 22.31 stop-loss for the shares that remain, lowering it to 22.21 if 21.76 is touched. _______ UPDATE (March 19, 12:55 p.m. EDT): The stock bottomed at exactly 22.76, so we covered the remainder of our short position at 22.21. The trade was a scratch. It seems most unlikely to me that BBY is going to surpass such a clear Hidden Pivot target by much, but we’ve closed out the position nonetheless, sticking with our discipline.