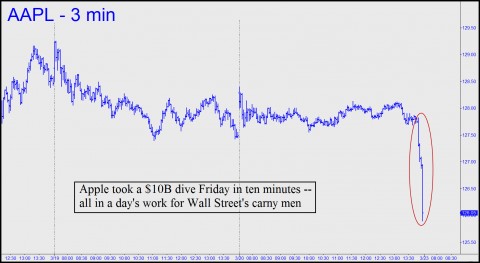

Rick’s Picks treats all securities markets like a carnival midway because both were designed to fleece rubes. Entertaining proof of this came in the form of the steep dive Apple shares took in the final minutes of Friday’s session. Money was lost, and we’re not talking about chump change, either, since AAPL, with a capitalization of more than $700 billion, is the most valuable stock in the world. ZeroHedge estimated that the sudden, $2 drop caused $10 billion in market cap to vanish in minutes.

And to what end? We may never know for sure, but you can bet that those who were short expiring call options at the $127 and $126 strikes were pleased when the stock dove from $128 to $126 just ahead of the bell. Open interest totaled a reported 105,000 options, but it’s impossible to tell the extent to which they were hedged. There were almost certainly some very big winner and losers, but my guess is that no heads will roll. Call it business-as-usual in a world where humans can nearly always find a machine to blame. Which brings us to the Question of the Week: Have you ever been ripped off by Wall Street?

And to what end? We may never know for sure, but you can bet that those who were short expiring call options at the $127 and $126 strikes were pleased when the stock dove from $128 to $126 just ahead of the bell. Open interest totaled a reported 105,000 options, but it’s impossible to tell the extent to which they were hedged. There were almost certainly some very big winner and losers, but my guess is that no heads will roll. Call it business-as-usual in a world where humans can nearly always find a machine to blame. Which brings us to the Question of the Week: Have you ever been ripped off by Wall Street?

Sure, I’ve been ripped off plenty of times. It is especially prevalent with computerized trading systems that “think” faster than me. Mostly, though, it’s the “fast money” players who’ve been ripped off, I believe. Staring at a monitor day-by-day and week-by-week creates ghosts. We are an impatient lot, and Wall Street knows what scares us.