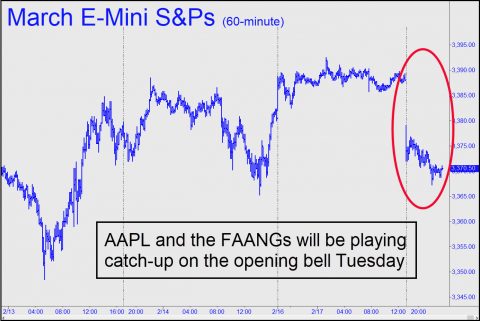

Index futures were getting drubbed Monday night on news that Apple’s Q1 revenues will take a hit from coronavirus-related work slowdowns and lower iPhone sales in China. However, it remained to be seen whether this so-far controlled selloff will become an avalanche when stocks open Monday morning. If it were a Sunday night, the FAANG/lunatic stocks would be moving lower in tandem with the E-Minis. However, it would appear that exchange rules governing holiday trading have left stocks temporarily frozen at Friday’s record highs. Will they plummet on the opening bell in order to catch up with the overnight selloff? My hunch is that they will and that the plunge will be unusually nasty.

Index futures were getting drubbed Monday night on news that Apple’s Q1 revenues will take a hit from coronavirus-related work slowdowns and lower iPhone sales in China. However, it remained to be seen whether this so-far controlled selloff will become an avalanche when stocks open Monday morning. If it were a Sunday night, the FAANG/lunatic stocks would be moving lower in tandem with the E-Minis. However, it would appear that exchange rules governing holiday trading have left stocks temporarily frozen at Friday’s record highs. Will they plummet on the opening bell in order to catch up with the overnight selloff? My hunch is that they will and that the plunge will be unusually nasty.

Ordinarily the arse bandits who work the night shift tend to let stocks fall hard on Sunday night when there has been disquieting news over the weekend. Their strategy is to take prices down low enough to dry up sellers, making it easier to run stocks back up the old wazoo after the bombed-out opening bar. This can be a tricky engineering feat, but it invariably succeeds when DaBoyz flip the switch to send short-covering bears into a full-blown panic. In this case, though, at the opening bell, the pros will be hard-pressed to predict the exact extent of the FAANG selloff about to unfold. But once it begins they’ll need to let it run its course and bring the broad averages down even lower in sympathy.

Their One-Trick Pony

It’s a feedback loop that is bound to be worse than on a Sunday night, when stocks are free to trade on the news rather than having to wait half a day to catch up with it. The Masters of the Universe could find themselves deeply underwater by mid-day, but don’t expect them to sit for long on all the shares they’ve had to suck up. They will attempt to goose bears as viciously as possible to get the obligatory short-squeeze going. Given the circumstances, this squeeze could be memorable — the moreso, perhaps, if their one-trick pony should go lame in the attempt. _____ UPDATE (9:01 a.m. EST): You can unbuckle your seat belts, since the rough-and-tumble is about 90% over. The exchanges, unfailingly helpful to the Wall Street mafia that keeps the game rigged, unleashed stocks at 4 a.m. (who knew??), enabling them to get as fully oversold as index futures ahead of the opening bell. With about 27 minutes to go before the public floods in, AAPL has recouped more than half of its $15 plunge to $310. It has traded as high as $319.77 on the bounce and is murdering shorts at the moment. They are buying stock from exchange-sanctioned criminals who acquired it down near $310 in a fleeting moment of heavily manipulated ‘opportunity’. That is how the game is played, a carnival midway on an epic scale. Credit an assist from roving clowns supplied by the business channels. Next amazing trick: Make everyone completely forget about AAPL’s revenue slowdown in China, its second-largest market. That could take a few more days. _______ UPDATE (11:54 a.m.): Stocks are relapsing sharply following a game try to run ’em up shorts’ old wazoo. If the Dow closes down more than 500 points, that would be the ‘lame pony’ scenario mentioned above. It’s nice to see the arse bandits getting buggered themselves for a rare change.

ill stay the course of sanity and short but we got no hope .. watched 5 minutes of garbage on CNBC .. these guys can never be stopped .. loaded dice and marked cards .. they are