“In the options game, no bet offers more leverage than Friday expirations.”

– Rick Ackerman, former San Francisco PSE market maker

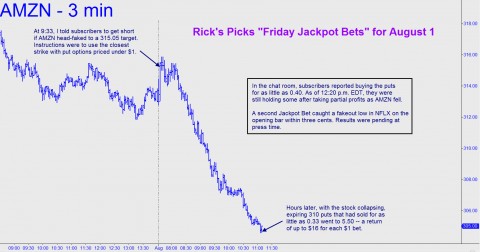

Example: on August 1 in the Rick’s Picks chat room, our ‘jackpot bet’ on $AMZN produced gains of as much as 1600% when put options due to expire that day exploded from 0.33 to 5.50 in mere hours.

Results for our highly leveraged and experimental ‘jackpot bets’ have continued to exceed expectations. To rack up substantial gains subscribers have only needed to hit one winner for every eight jackpot trades. However, the past weeks have produced three winners and three break-even trades.

The chart above (click to expand) shows when the trade was entered, in the early minutes of the session. The bet itself was based on the tendency of stocks to go against the dominant trend on the opening bar. This occurs because the specialists who make markets in stocks have a great deal of leeway in fading the opening order flow. Rick has considerable expertise in this area, having been an options market maker himself on the floor of the Pacific Stock Exchange for 12 years.

Subscribers are encouraged to follow just a few simple rules:

- Use Rick’s Hidden Pivot targets in whatever way best suits your appetite for risk.

- Buy the closest strike at which puts or calls are priced below $1.

- Don’t worry about buying the options at the absolute best price, since you’ll be swinging for the fences.

- Wait till the underlying stock is very close to the target before jumping in.

- If the option price doubles, take profits on half the position.

- Exit the remainder of the position at will, but before the final bell.

Only Rick’s Picks subscribers who are in the chat room can participate, and it may be necessary to limit their number, since liquidity in the distant strikes traded is a crucial concern. See you in the chat room bright and early!

Sincerely,

Rick Ackerman

Editor, Rick’s Picks