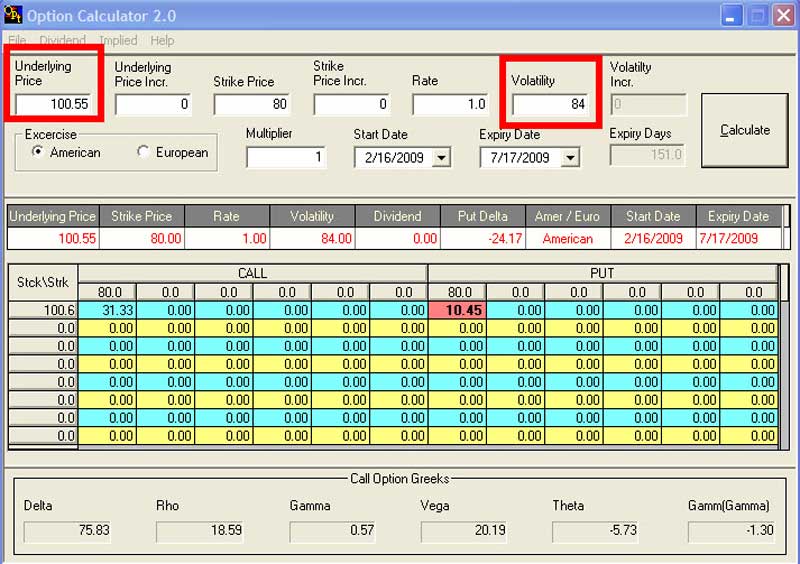

I’m resisting the temptation to say the hell with pivots, let’s just short this hoax. We’ll stick with our usual, disciplined approach nonetheless, initiating trades only at Hidden Pivot rally targets (of which there are unforunately too many at the moment). The nearest worth a shot looks to be 100.55, so let’s try to buy one July 80 put (GSSP) if and when the stock closely approaches the target. I estimate the put will be selling for around 10.45 then (see snapshot of calculator; I’ve plugged in a Tradestation volatility of 84). Option volatilities for GS are in the stratosphere, and that is why we are taking a cautious approach. Even so, there is some edge in acquiring July puts for anything close to fair value, since they do not routinely come in for sale. ______ UPDATE: GS scorned our timid attempt to get short, opening lower on a huge gap. The stock is currently down $8.55, 20 cents off the so-far intraday low.

I’m resisting the temptation to say the hell with pivots, let’s just short this hoax. We’ll stick with our usual, disciplined approach nonetheless, initiating trades only at Hidden Pivot rally targets (of which there are unforunately too many at the moment). The nearest worth a shot looks to be 100.55, so let’s try to buy one July 80 put (GSSP) if and when the stock closely approaches the target. I estimate the put will be selling for around 10.45 then (see snapshot of calculator; I’ve plugged in a Tradestation volatility of 84). Option volatilities for GS are in the stratosphere, and that is why we are taking a cautious approach. Even so, there is some edge in acquiring July puts for anything close to fair value, since they do not routinely come in for sale. ______ UPDATE: GS scorned our timid attempt to get short, opening lower on a huge gap. The stock is currently down $8.55, 20 cents off the so-far intraday low.