Borrowing Our Way Back to Prosperity

Here’s Mike Huckabee, former governor of Arkansas, cutting to the quick yesterday on Fox: “You can’t spend your way to prosperity,” said Huckabee, “with money you don’t have.” Hard to argue with that statement. And if Americans understand this, as they very likely do, we should expect to see Fox’s ratings climb in the weeks and months ahead. Fox has been nearly alone in applying common sense to its analysis of the Democrats’ various stimulus packages, and, more recently, to the prospect of big new taxes that the Obama administration is considering.

Here’s Mike Huckabee, former governor of Arkansas, cutting to the quick yesterday on Fox: “You can’t spend your way to prosperity,” said Huckabee, “with money you don’t have.” Hard to argue with that statement. And if Americans understand this, as they very likely do, we should expect to see Fox’s ratings climb in the weeks and months ahead. Fox has been nearly alone in applying common sense to its analysis of the Democrats’ various stimulus packages, and, more recently, to the prospect of big new taxes that the Obama administration is considering.

Read The Rest of The Article | Comments

***

Helicopter Ben’s Assurances Ring Hollow

So, Helicopter Ben believes he’s got inflation under control. That’s like Nagasaki’s public health director saying two days after the bomb that he’s got strep throat under control. The Fed chairman also said he didn’t see a need to nationalize the banks. That would the mayor of Nagasaki speaking, saying he saw no reason for Japan to surrender. Duly noted – and stay calm, folks. But in either case, the events of the day have pre-empted anything the Fed might have been planning. There was never a possibility of “controlling” inflation because deflation has gone rampant around the world, laying waste to nearly all asset classes except bullion, and, for the moment, Treasury paper and dollars.

So, Helicopter Ben believes he’s got inflation under control. That’s like Nagasaki’s public health director saying two days after the bomb that he’s got strep throat under control. The Fed chairman also said he didn’t see a need to nationalize the banks. That would the mayor of Nagasaki speaking, saying he saw no reason for Japan to surrender. Duly noted – and stay calm, folks. But in either case, the events of the day have pre-empted anything the Fed might have been planning. There was never a possibility of “controlling” inflation because deflation has gone rampant around the world, laying waste to nearly all asset classes except bullion, and, for the moment, Treasury paper and dollars.

Read The Rest of The Article | Comments

***

Warm Fuzzies Ignites Stocks, Cools Gold

For a few shining hours yesterday, anyone monitoring the markets might have believed that all was right with the world. Shares were sharply and broadly higher, precious-metal bulls were getting savagely rebuked, and the Fed Chairman was acting as though he’s got everything nicely under control. Bernanke in fact predicted the recession would end this year and give way to a recovery in 2010 if actions taken by the government lead to some stabilization in financial markets. However, as the Wall Street Journal noted online, that’s a mighty big ‘if.” Not long ago, we had classified as a lunatic anyone professing to see light at the end of the tunnel in 2009. We’ll be more charitable toward Mr. Bernanke, however, since it is his job, as it was Mr. Greenspan’s before him, to obscure the true state of the economy even in relatively good times.

For a few shining hours yesterday, anyone monitoring the markets might have believed that all was right with the world. Shares were sharply and broadly higher, precious-metal bulls were getting savagely rebuked, and the Fed Chairman was acting as though he’s got everything nicely under control. Bernanke in fact predicted the recession would end this year and give way to a recovery in 2010 if actions taken by the government lead to some stabilization in financial markets. However, as the Wall Street Journal noted online, that’s a mighty big ‘if.” Not long ago, we had classified as a lunatic anyone professing to see light at the end of the tunnel in 2009. We’ll be more charitable toward Mr. Bernanke, however, since it is his job, as it was Mr. Greenspan’s before him, to obscure the true state of the economy even in relatively good times.

Read The Rest of The Article | Comments

***

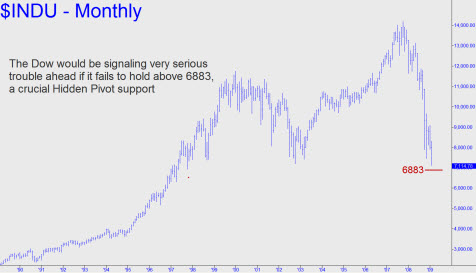

Dow’s Big Chance Will Come at 6883

For those who have been patiently waiting for a day of climactic selling to end the bear market, yesterday surely was not it. It was instead more of the same death-by-a-thousand-cuts bloodletting that has halved the Dow Industrial Average since the 30-stock index recorded an all-time high at 14198 in October of 2007. At Monday’s close the blue chip average stood at 7115, down 3.4 percent on the day and 18.9 percent so far this year. Don’t give up hope, though. A respite from the selling could conceivably come soon, since the Indoos are just 232 points from a Hidden Pivot at 6883 that has served as our minimum downside target since January 12, when a bearish “trigger pivot” at 8537 was hit.

For those who have been patiently waiting for a day of climactic selling to end the bear market, yesterday surely was not it. It was instead more of the same death-by-a-thousand-cuts bloodletting that has halved the Dow Industrial Average since the 30-stock index recorded an all-time high at 14198 in October of 2007. At Monday’s close the blue chip average stood at 7115, down 3.4 percent on the day and 18.9 percent so far this year. Don’t give up hope, though. A respite from the selling could conceivably come soon, since the Indoos are just 232 points from a Hidden Pivot at 6883 that has served as our minimum downside target since January 12, when a bearish “trigger pivot” at 8537 was hit.

Read The Rest of The Article | Comments

***

Gold’s Assault on the Clueless

We’ve been monitoring gold’s vital signs closely, since any foray above $1000 is cause for nervousness. The yellow stuff has always been free to roam, and even to misbehave, below that threshold; but once above $1000, the bankers regard each rally with a glower of malice. While it is clear that debt deflation’s overwhelming power has rendered the central banks impotent in their efforts to arrest the collapse of the global economy, the bankers still retain the ability to crush any hint of rebellion by gold bulls who would deign to challenge the monetary order. With their relatively large stocks of physical gold, and the complicity of institutional agents such as JP Morgan to help suppress “paper gold” in futures markets, the bankers and the IMF have enough influence over bullion’s price to temporarily suspend the laws of supply and demand.

We’ve been monitoring gold’s vital signs closely, since any foray above $1000 is cause for nervousness. The yellow stuff has always been free to roam, and even to misbehave, below that threshold; but once above $1000, the bankers regard each rally with a glower of malice. While it is clear that debt deflation’s overwhelming power has rendered the central banks impotent in their efforts to arrest the collapse of the global economy, the bankers still retain the ability to crush any hint of rebellion by gold bulls who would deign to challenge the monetary order. With their relatively large stocks of physical gold, and the complicity of institutional agents such as JP Morgan to help suppress “paper gold” in futures markets, the bankers and the IMF have enough influence over bullion’s price to temporarily suspend the laws of supply and demand.