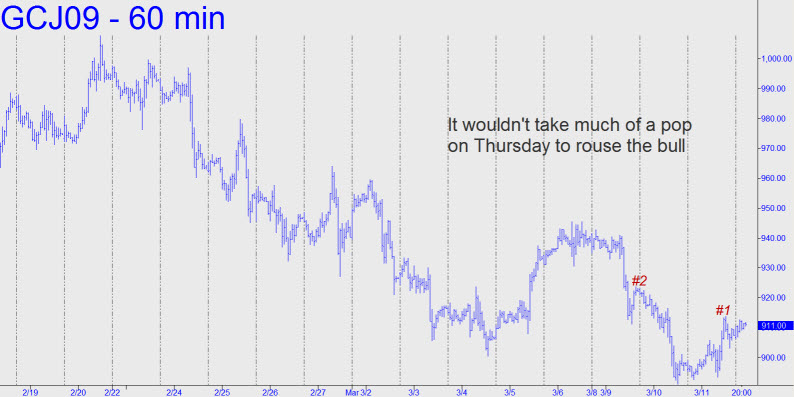

The downside targets given here yesterday remain valid, as do the bottom-fishing opportunities that I detailed with stops. (To find this recommendation or any other in the archive, simply search on “April Gold” or the relevant symbol.) Concerning bullish prospects for the near term, the fact that yesterday’s rally did not surpass two prior peaks on the hourly chart is discouraging. Still, it wouldn’t take much of a pop Wednesday night or Tuesday morning to remedy that. Let’s set the bar at 923.80 today to alert us when it’s time for bulls to perk up. On the hourly chart, the ABCs of yesterday’s price action would seem to promise 923.50 (midpoint resistance: 913.30), but I don’t have much confidence in the pattern because the point ‘B’, 913.80 is hanging in space, having failed to exceed the lowermost peak to the left from Tuesday. _______ UPDATE: Here’s a sequence of targets that appears to be playing out early Monday morning (it is currently 2:17 a.m.), with the futures trading just off a so-far high of 915.60: 917.80…. 920.30….923.50. The breach of one by more than 3-4 ticks would imply the next is likely to be reached.

The downside targets given here yesterday remain valid, as do the bottom-fishing opportunities that I detailed with stops. (To find this recommendation or any other in the archive, simply search on “April Gold” or the relevant symbol.) Concerning bullish prospects for the near term, the fact that yesterday’s rally did not surpass two prior peaks on the hourly chart is discouraging. Still, it wouldn’t take much of a pop Wednesday night or Tuesday morning to remedy that. Let’s set the bar at 923.80 today to alert us when it’s time for bulls to perk up. On the hourly chart, the ABCs of yesterday’s price action would seem to promise 923.50 (midpoint resistance: 913.30), but I don’t have much confidence in the pattern because the point ‘B’, 913.80 is hanging in space, having failed to exceed the lowermost peak to the left from Tuesday. _______ UPDATE: Here’s a sequence of targets that appears to be playing out early Monday morning (it is currently 2:17 a.m.), with the futures trading just off a so-far high of 915.60: 917.80…. 920.30….923.50. The breach of one by more than 3-4 ticks would imply the next is likely to be reached.