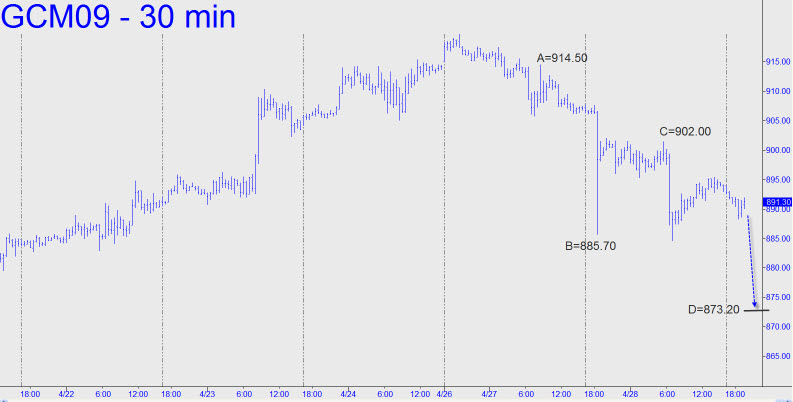

As a minimum downside target for the near term, let’s use the 873.20 Hidden Pivot shown in the chart. The point ‘B’ I’ve used is not ideal because it failed to take out the cluster of minor lows recorded a week ago, but the overall pattern has the kind of heft that gives it authority. If the futures overshoot the target by more than 3-4 ticks, expect the selling to continue down to 868.00, a Hidden Pivot that you could bottom-fish aggressively with an 868.10 bid and a stop-loss as tight as 1.10 points. Alternatively, if Gold heads higher, we can use 914.60 as a bullish trigger, since a print there would turn the 15-minute chart unambiguously positive. _______ UPDATE (1:45 p.m.) During Wednesday morning’s tutorial session we identified a minor rally target at 905.00, but it didn’t look like there was sufficient wattage to take the futures much higher, at least not today.

As a minimum downside target for the near term, let’s use the 873.20 Hidden Pivot shown in the chart. The point ‘B’ I’ve used is not ideal because it failed to take out the cluster of minor lows recorded a week ago, but the overall pattern has the kind of heft that gives it authority. If the futures overshoot the target by more than 3-4 ticks, expect the selling to continue down to 868.00, a Hidden Pivot that you could bottom-fish aggressively with an 868.10 bid and a stop-loss as tight as 1.10 points. Alternatively, if Gold heads higher, we can use 914.60 as a bullish trigger, since a print there would turn the 15-minute chart unambiguously positive. _______ UPDATE (1:45 p.m.) During Wednesday morning’s tutorial session we identified a minor rally target at 905.00, but it didn’t look like there was sufficient wattage to take the futures much higher, at least not today.