(Following is the fifth in a series of article on gold by Chuck Cohen, a financial consultant and investor based in New York City. At bottom are some specific stock recommendations.)

Very few Americans own gold in any form. Even though gold’s price has risen each year since 2001, about the only time we hear gold mentioned is in the ubiquitous “cash for gold” TV commercials. Don’t you wonder who has any gold or jewelry left to sell? The way it’s shunned, you might think gold causes swine flu or greenhouse emissions. It is most baffling to me to see our profligate nation diligently avoiding the most rewarding investment of the last decade.

Under the circumstances, it is hardly surprising that only a miniscule number of investors have ever ventured into the most speculative field of gold, the exploration companies. These small and unproven companies might have market capitalization of anywhere from $5 million to over $200 million. Some contain proven reserves, while some are still searching for the mythical El Dorado. But even to many gold experts and believers they remain intensely speculative and risky, perhaps leaving you to wonder, why bother?

Here are some of the reasons often given for avoiding them.

- Only a tiny fraction of these properties ever get into production

- They are vastly undercapitalized. Small diluting financings pop up more often than do the shares

- Many are run by promoters who pump up the stock so they can unload their shares.

They Mine Money

Now there might be some truth in these claims if these were ordinary times. But just consider that if you had applied these same arguments in the early 1990s, you would have missed out on the greatest speculative binge of our time – the technology-stock boom. (Actually, most of us did miss it.) Few except for the true techies and the entrepreneurs who ran these companies really believed that these start-ups would ever succeed. But the shares of many of them increased in price a hundred-fold before the mania ended.

And that is what I expect this time, though to an even greater degree, since these companies are mining “money” in its most pristine form, and the wind is at their backs. Many will be virtual mints in a time of incredible paper currency turbulence and destruction. Yes, they are speculative, but I like the odds. Here is a very fundamental point in investing: The greatest gains have been in those investments that were shunned the most. As Mr. Buffett — Warren not Jimmy – likes to say when asked about his success, “I buy when everyone else in selling and sell when everyone is buying.”

Pac-Man Effect

Further details concerning these stocks and a sound investment strategy will be coming up next week. For now, though, you should know that:

- The gold grades in the world’s largest mines are persistently declining.

- The much larger senior companies such as Newmont, Barrick and Goldcorp will need to buy more and more reserves. A Pac-Man syndrome or a swallowing up by the larger of the smaller is surely coming.

- South African gold production continues to drop dramatically.

- There is a continuing shortage of new gold production.

- There have been very few major discoveries in the past 20 years.

- Almost all of the successful drilling over the past 10-15 years has been done by these smaller companies.

- Most of the top geologists have gone to these companies.

- Management has a huge vested interest. Most take little remuneration because they believe in their companies and are looking for the big payoff for their companies.

- Few individual or institutional investors have any position in these companies.

- The last two years pressured down the gold companies across the board as the liquidity squeeze proved particularly cruel to the smaller companies. To me this shows that they are still not a consideration in spite of the compelling evidence.

- In spite of a move from $35 to nearly $1000 over almost 40 years, there has not been any lengthy move in the shares and no real sign of speculation.

- They represent a perpetual option against the price of gold.

- Many are selling for the equivalent of $50 per ounce in the ground. This carries a ridiculous leverage. If a company has a proven one million ounces in the ground and a $10 million market cap what is its true potential value? It takes very little imagination to consider what their properties would be worth at $1500 or even $3000 gold.

Some Stocks to Consider

Above all, there are the two overriding reasons to own gold — one fundamental, the other technical. Concerning the former, the monetary landscape and the certainty of more and more fiat money will keep the gold fires burning brightly. As for technical reasons, on the charts, gold has been consolidating for years to launch into a parabolic rally.

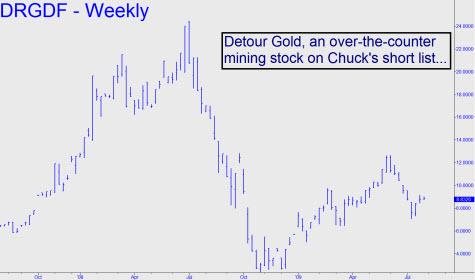

For your consideration, here are some specific stocks that I like: San Gold (OTC: SGRCF); Detour Gold (OTC: DRGDF); Mauodore Minerals (Toronto; MAO); Golden Predator (OTC: GPRXF); Pediment Gold Corp (OTC: PEZGF); Great Basin Gold Ltd. (AMEX: GBG); Skygold (OTC: SKYVF): Moneta Porcupine (OTC: MPUCF); Midway Gold Corp (OTC: MDW), and Evolving Gold (OTC: EVOGF). There will be others that I plan to discuss shortly.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here. )

Hmmm.

The borrower still servant to the lender.

That would be Uncle Sam with his taxpayer funded Treasury debt since 1913.

DR, JR and the Bank cartel, RR and Armand Hammer beat the Africans, Arabs, Bache, Hunts, Japanese, Kidder Peabody, Phibro (Salomon) and Soviets into the ground, the soiled IBanks bribed Congress and SEC to repeal Depression regulations and rules, changed mark to market accounting rules to report record profits with free Fed and cheap Taxpayer money, the futures exchanges changed rules to suit themselves, while our economy contracted in excess of 10%, the definition of Depression, with China gagging on central planning and FXI a superb short from 42.95.

Will someone please make a coherent persuasive argument with evidence for gold going up now? Or is this a faith healing forum?

PS: Carolyn Hunt who stayed in cash came through 1980 well as interest rates soared to double digits.

JubileeProsperity.com may show some more points of light, LOL…