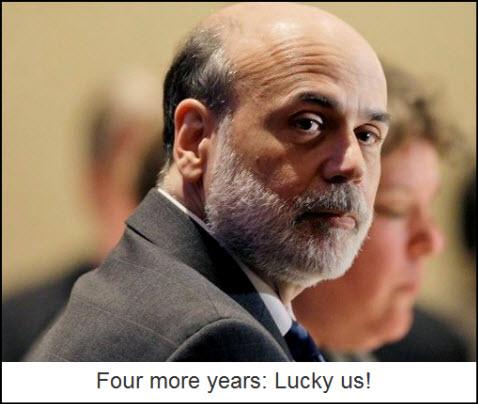

There was discouraging news yesterday for anyone hoping that Rep. Ron Paul’s bill to abolish the Federal Reserve might make it to the floor during the current Congressional session. The way things look right now, H.R. 2755 may not come up for a vote for quite a while – at least for the duration of Mr. Obama’s presidency. By nominating “Helicopter Ben” Bernanke to a second term, the President made clear that the political champions of a so-far catastrophically unsuccessful status quo will continue to rule our economic lives, at least for the foreseeable future. If that weren’t bad enough, Mr. Bernanke’s “success” is likely to be judged on the basis of how well he sustains the flow of easy credit in an economy on the verge of being crushed to death by debt.

The reasoning behind Mr. Obama’s choice was made clear in the lead story in yesterday’s Wall Street Journal. The headline, “Calm in Crisis Won Fed Job,” suggests that the President was understandably reluctant to rock the boat, presumably by appointing Larry Summers, the only other guy who had been mentioned as a serious contender for the job. A second headline was more telling, however: “Next Term Could Be Tense if Rates Rise“. Imagine being appointed to the most powerful position in the banking world, only to be told that your main responsibility would be to hold interest rates down. It is a benighted political class that would demand such a thing, of course, and an economically unenlightened populace that would come to rely on it, as we surely have.

Crazy Eddy

If holding rates down is Bernanke’s main job, perhaps a separate czar should be appointed to goad us into borrowing and spending the excess cash that lower rates could produce. That would spare the Fed chairman the unseemliness of having to tell us that buying cars, refrigerators and big-screen television sets, and bidding up home prices, is going to restore America to economic health, never mind greatness. We can think of a few candidates for the job: Crazy Eddy, of consumer electronics notoriety; George Zimmer, CEO of The Men’s Wearhouse; and John Elway, Denver’s #1 used-car salesman. In another era, the government might have exhorted us to buy the equivalent of war bonds. Now, though, the idea of forced saving is unthinkable, since nothing could be more deflationary. Not that anyone would actually buy a low-coupon bond these days as an investment in America’s future. That is not what is selling Treasury paper any more, although we are hard-pressed to say exactly what is.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

GOOD NEWS!!! There is finally a great new movie out about stock market manipulation, the SEC, and short selling called: “Stock Shock.” On DVD only, of course. Amazon has it or stockshockmovie.com has a trailer.