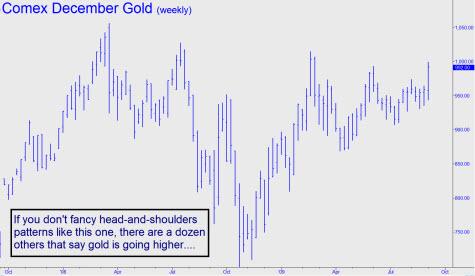

We’re no fans of head-and-shoulder formations, since they are everywhere the amateur chartist might want to find them. But there is something to be said for the bullish reverse head-and-shoulders pattern that gold futures have been tracing out for the last year-and-a-half. The pattern is shown in the chart below, and it is predicting that December Gold, which settled yesterday at 997.70, its highest close since February, is about to run up to $1060. Trouble is, just about everyone we know thinks gold is about to pop to 1060, give or take. Or nearly everyone, anyway. Someone mentioned in the Rick’s Picks chat room that CNBC’s Ron Insana can’t imagine why gold has been so strong. Earth to Ron: Put down that copy of the New York Times for a minute and try browsing Goldseek, Kitco and Gold-Eagle. That’ll jump-start your imagination.

A little hoopla is natural every time gold butts up against $1000, as it has done no fewer than four times so far this year. Old-timers might remember the excitement on Wall Street when the Dow Industrials in 1966 first approached 1000. Few would have imagined at the time that it would be another 16 year before the Industrial Average finally leapt past 1000. We don’t think gold bugs will have so long to wait, although some of them might tell you they’ve already waited for nearly 30 years for gold to deliver on the promise of its spike to an $850 in 1980.

$1175 on Comex December?

Head-and-shoulders patterns aside, just about every decent technician we know is looking for a breakout above $1000 right now. One of the very best of them, Institutional Advisors‘ Ross Clark, the Mozart of the charting world, is focusing on a triangle pattern that encompasses the right side of our motley H&S formation. From this he has deduced that gold is ready to pop to at least $1034, and thence to $1100. Our own Hidden Pivot analysis takes gold easily to $1074.00, but we could see $1175 (basis the December Comex contract) if the rally should exceed that number by more than a few bucks. What then? Hard to say, but if gold is indeed about to break loose, it would imply that the world financial order is about to experience some wrenching changes.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Dudes,

The next step is currency devaluation to get out of the crisis. Has anyone even considered that buying gold while a currency is strong will store the value of that currency even though the currency eventually devalues?

There has to be one aspect to gold that many investors tend to neglect. I think its due to the fact that gold has not served as a way of storing value in anticipation of a currency devaluation. At least, not yet.

Think of the Icelandic Krona. This was, at one time, the most overvalued currency in the world not too long ago, but went into devaluation against the Euro once their banking system collapsed. Citizens were prevented from trading Krona for foreign currencies. But if they had bought bullion, it would have remained liquid on a par with more stable currencies and you would have faced no restrictions on trading it for the now devalued Krona and obtained a multiple of the purchasing power that it had prior to the collapse.

Did anyone in Iceland stop to think for a moment that while their currency was the strongest currency in the world to stock up on bullion? The bankers certainly didn’t.

The Icelandic Financial Crisis and devaluation of its currency should serve as an object lesson for the purpose of owning gold or gold mining shares. (look at the Icelandic exchange) In the present world financial crisis, they are talking negative interest rates in Sweden and possibly the UK and the IMF bailing out lesser currencies as of late. I think it serves as a model to go by.

http://en.wikipedia.org/wiki/Icelandic_financial_crisis