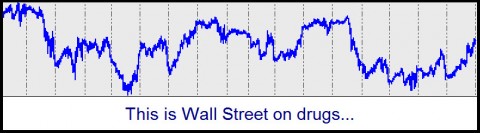

If the chart below were your comatose Aunt Minnie’s EEG, her doctor might tell you it was time to pull the plug. “There’s still some electrical activity in you’re aunt’s brain,” he would explain, “but it seems highly doubtful that she will ever return to a normal and productive life.” Just so, even if it is a stock chart that we have reproduced, not an electroencephalograph. Specifically, it is a graph of price action in the E-Mini S&Ps over the last three weeks, and it could be argued that it does indeed represent an accurate picture of brain activity – such as it is — in the investment world. Whatever the case, there is no disputing that every little squiggle was put there by a human being, or at least by a computer programmed by a human being, and that fear and greed are manifest at each and every peak and trough.

We would also note that the ups and downs traced out in this chart, although somewhat irregular, do not evince a sense of crisis or even urgency. There is just not much going on, as we can all agree. Would it therefore surprise you to learn that the dainty little fillip toward the right-hand edge of the chart represents yesterday’s nearly 300-point rally in the Dow Industrials? Amazing how insignificant it looks when placed in perspective. The nightly-news anchors will give this latest supposed evidence of Wall Street’s bullish mood ten seconds’ worth of spin, and then most viewers will simply shrug it off, wondering what the heck it was that investors could have been celebrating. In fact, as the chart makes clear, investors were simply continuing to do what they’ve been doing since mid-May – i.e., screwing the pooch.

It’s Friday!

More of the same as the week draws to a close? We’re inclined to say yes, that stocks will finish on some sort of gratuitous upswing. This is due mainly to the fact that yesterday’s 33-point rally in the S&P futures exceeded our 1086.00 target by nearly two points. That might not sound like much, but it is surely more bullish than if the futures had not quite reached the target. Incidentally, it is not bulls who are doing the buying, as we like to point out; rather, it is bears covering short bets that have gone against them. The Dow’s 500-point undulations cannot continue indefinitely, but we have a feeling that the tedium they have produced in recent weeks will be sorely missed when the broad averages make their next move.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

I just saw a story in the Financial Times that the FBI plans a big crackdown on……… Mortgage Fraud!

So the current market activity is a relief rally!

We were all reading about mortgage fraud back in 2005 or earlier on numerous blogs devoted to the real estate bubble.

Now that the banking system and economy are destroyed, the FBI is on the case! LOL!

On another matter, I just read that Congress is fed up with China’s one sided trade policy and ready to take action! Double LOL!

That makes the FBI look like a rapid response team!

The Marx Brothers in “Duck Soup” comes to mind.

Obama should sing Groucho’s refrain:

“The last guy screwed this country up, he didn’t know what to do with it.

If you think this place is bad off now, just wait till I get through with it!”