Opening up a bearish position yesterday morning not long after trading began, we caught a fine breeze that allowed us to short the Diamonds just pennies off their hysteria-driven, opening-hour high. Here’s the trading recommendation exactly as it went out to subscribers the night before:

“Buy four August 98 puts if DIA gets within 0.05 points of the next Hidden Pivot resistance above, 105.92. You should be prepared to buy four more August 98 puts later if the Diamonds get past 105.92, since that will imply they’re going to at least 106.73 before a top is in. We are going out to August because the remaining life of the July options will be shortened not only by their July 15 expiration date, but by a holiday weekend.”

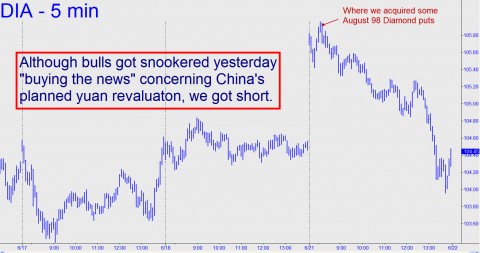

As it happened, the Diamonds took a powerful leap at the bell, responding to ostensibly bullish news that China will allow its currency, the yuan, to rise. We were in luck to have bet against the crowd, since the rally ultimately went no farther than 105.96 – just four ticks above our target. That gave us a perfect opportunity to get short at the height of the short-squeeze, moments before DaBoyz pulled the plug on frenzied buyers. Look at the chart below if you want to see what a classic bull trap looks like, especially when its sprung on a Monday morning on news that has been timed for maximum effect:

Because we had anticipated the rally top very precisely with Hidden Pivot analysis, we were able to buy August 98 puts for 1.28, three cents off their intraday low. Later in the day, we took a partial profit on the position as is our custom, selling half of the put options for 1.50. This effectively reduced the costs basis of the puts we still hold to 1.06. Here’s the trading recommendation that went out to subscribers at 12:42 p.m. EDT via an intraday bulletin: “Using a 1.50 offer, exit half of the puts purchased earlier this morning for 1.28. With DIA trading 105.10, the puts are currently reflected at 1.47-1.52.” We needn’t have hastened, since, with the Diamonds falling like a brick, the puts were streaking toward an intraday high of 1.73 (a “12000% annualized gain!!!!!” in the promotion-speak of some of our guru competitors, by the way.)

Few Winners

We routinely take partial profits early in a put trade because, in the 37 years we have been trading options both on and off the exchange floor, we can recall only a couple of instances when a retail customer we knew actually made money holding puts. Even when stocks crashed in 1987, those who had bought puts for the ride were so busy patting themselves on the back that they got crushed when stocks trampolined higher with a vengeance on Tuesday, October 20. Moreover, in all of those 37 years, there have probably been no more than one or two periods lasting longer than two days during which those who held puts felt anything even remotely like exhilaration. And that is why we are quick to take at least a partial profit on all option trades, but especially on put-option trades. As a result of yesterday’s refreshing little frisson, we still hold half the original position, with a cost basis of 1.06 per put option against yesterday’s closing price of 1.70. Our timely entry will make it hard to lose, but we are obliged to warn you that options trading is a very tricky game, and that most of those who attempt it lose their shirts. Nor should past performance be construed as a guarantee of future success.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

On pure logic and lack of patience I would agree with your call. In fact it might be a great call but since i have tempered my impatience with fibonacci turn dates I am anxiously waiting to buy PUTS.

I will be buying on Friday if we remain range bound.

The housing market is falling apart. No hyperbole intended. While the retail sales figures only show one monthly drop it coincides well with a general feeling that the consumer is slipping back. The huge increase in debit cards also suggests a permanent trend change away from debt.

We haven’t heard much from the EU lately but I suspect we will. We also have window dressing from the mutual funds.

Earning season is also upon us. If anything will cause a huge trend change it will be diappointing earnings projections.

My “gut” feeling is that the second vicious drop is upon us. Not very scientific but I have had this feeling only 2 other times, one in 1987 2 months before the drop, and 17 months ago. I made no money in 87 but did have all money in cash, and I did capitalize on the last crash. I do not suggest anyone bet on my “gut” method but do suggest you have a quick trigger if this market starts unraveling.

As for the concept of market manipulation, I do not hold much faith that it can hold up a market determined to find fair value.