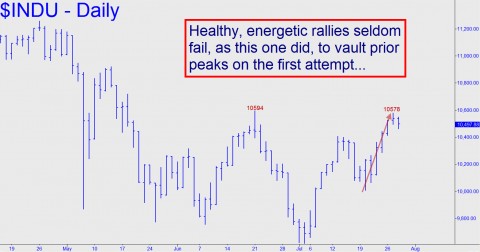

We were looking for a 350-point rally as the week began, but at the rate stocks have been rising it could be Labor Day before the Dow Industrials hit our 10757 target. In the meantime, dirges like yesterday’s could have satisfied neither bulls nor bears, since it took the blue chip average six tedious hours to work its way just 40 points lower. (Get a week’s worth of free forecasts, as well as access to the 24/7 chat room, by clicking here.) Ordinarily we would chalk this up as another day of consolidation within an uptrend that at times seems unstoppable. However, in this case there is a so-far minor concern that bears close watching, since it could be a harbinger of trouble immediately ahead. Specifically, the Indoos have pulled back from Tuesday’s fleeting peak without having exceeded the 10594 high recorded on June 21. You can see this in the chart below, and it suggests that buyers may have run out of steam earlier this week. Indeed, if they were feeling feisty, they would have demonstrated it by going the extra few inches to conquer the June 21 peak. Instead, they stopped 16 points shy of it before turning tail and heading lower.

In the parlance of the Hidden Pivot Method that we use to forecast stock and commmodity prices, this is an impulse-leg failure. According to the simple rules of this method, healthy rallies must continually refresh the bull trend by “impulsing” above two prior peaks with each new, cyclical thrust. Of course, the Dow could come roaring back this morning and surpass the two required peaks with room to spare. But it should have done this yesterday, on the first try and without a 40-point pullback, to be considered healthy and robust. Not that we think the rally has been healthy to begin with. In fact, we see no enthusiasm behind the uptrend – only a relative dearth of sellers to impede it. They have been pretty gingerly about this lately; however, for the reasons noted above, we should be alert to any acceleration in the selling as the week draws to a close. If this happens and the Dow settles tomorrow below last Friday’s 10425 close, it could set up a serious decline next week.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

IF WE ARE IN GOOD, GOLD/SILVER PRODUCING MINING STOCKS, WHEN THE MARKET FALLS, AND IT IS GOING TO DROP LIKE A ROCK, SHOULD WE HOLD ONTO THOSE GOOD STOCKS?

HELP OUT THERE!

WYN HARTER

&&&&&&

Seems like a foregone conclusion that mining shares will fall with the market when it finally collapses. On Thursday I posted correction targets for the HUI: a minimum 414.00, or 383.96 if any lower. RA