[This commentary from Rich Cash drew such a heavy response that we are re-publishing it today so that it can enjoy wider readership and a second round of debate in the Rick’s Picks forum. It is the second of two radical proposals we have aired for dealing with debt. In the first, Ben Rositas, a frequent contributor to the Rick’s Picks forum, argued for the redistribution of America’s gold bullion to households and to all who are owed. In the essay below, Cash, another forum regular and blogger, broaches the idea of a return to Biblical Jubilee, or something like it. Although we’ll concede that neither idea is even remotely feasible politically, consider the alternative: a debt deflation that locks the economy into a grinding Depression for the next twenty years. RA ]

Here’s Rich, with a message of (debt) forgiveness in his heart – and a plan:

“One Friday in the San Francisco Financial District after work, a group of movers and shakers got together at Harrington’s Pub for a liar’s dice game that rocked their foundations and changed their lives. There was such intense play, they ran out of Federal Reserve Notes. They played with cigarettes, matches and pieces of paper IOUs until stakes reached trillions. They worked in an industry where the credit of their word was

their bond, yet the stakes of the game became so high, they agreed to forgive each other’s IOUs so they could live to work and play again.

Leviticus 25

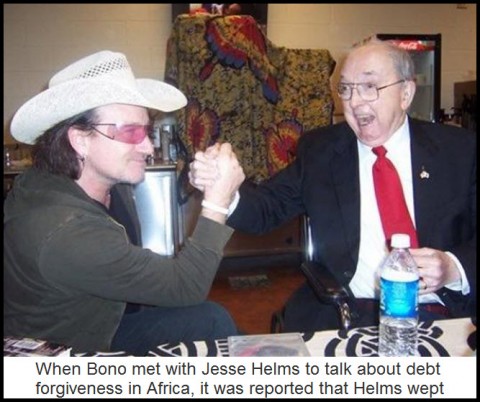

“In the Jubilee Year of Leviticus 25, those enslaved because of debts are freed, lands lost because of debt are returned, and community torn by inequality is restored. U2’s Bono invested a lot of time with the Jubilee2000 organization and World Economic Forum, arguing the best way to promote the development of poor countries was to forgive their debts. Bono met with Conservative Senator Jesse Helms, saying Helms wept when they spoke: “I talked to him about the Biblical origin of the idea of Jubilee Year…. He was genuinely moved by the story of the continent of Africa, and he said to me, ‘America needs to do more.’ I think he felt it as a burden on a spiritual level.

“Trevor Neilson of the Bill & Melinda Gates Foundation noted that the battle for development is going to be won at the backyard barbecue, not at the Council on Foreign Relations. Fast forward seven years, a Sabbatical. Seven Sabbaticals are a Jubilee. Now the irony is it is not developing nations like Brazil, China, India, Korea and South Africa looking for debt-forgiveness to move ahead, but everyday Americans, socked silly by auto loans, credit cards, food prices, medical care, mortgages, taxes, utility bills and nagged by the suspicion their corporation, government or union already spent their pension or Social Security before laying them off.

Bernanke’s Ambitions

“That this is a timely discussion was perhaps signaled by Ambrose Evans-Pritchard’s article last week in the UK Telegraph: ‘Ben Bernanke needs fresh monetary blitz as US recovery falters’. The article claims the Fed Chair now wants to more than double the Fed balance-sheet monetary base from $2.2 Trillion to $5 Trillion, after almost tripling it from 2008 to 2010. With a 9% decline in the monetary base this year, the alleged economic recovery, measured by Consumer Sentiment, Cost of Living, Employment, Foreclosures, GDP, Home sales, Manufacturing, and Tax Revenues, is rolling over again.

Regional Fed Hawks, echoing the 1930s, don’t want to blow the US Credit rating or Dollar out of the water with yet another insider asset bubble popping. Member banks and Americans cannot afford it. They want the Fed to start unloading $1.75 Trillion of Treasury bonds and mortgages the Fed bought during the crisis, which would pull more money out of the system and let people go back to work.

“The AEP article correctly observed the money multiplier is below 1 (83.8% to be exact), meaning for every additional debt dollar the Fed creates, the M1 supply loses 16.2 cents.

AEP cites the major mistake of the Fed as ignoring the broad economic money supply, buying assets from banks rather than people, as Paulson promised. M3 in fact contracted the last three months at a 7.6% annual rate, in case We the People were wondering why the reported recovery felt like a decline. Despite widespread talk of cutting government spending, taxes and war, nothing happened. Despite usury prohibitions in the Bible, Quran and Torah, it is clear America can no longer service her debt, and borrowers are slaves to lenders.

‘Slow Crash’ Wins

“What it may come down to is this: Bilderberger Bankers met in Spain and Turkey, reportedly to discuss whether the inevitable corrective crash should be fast or slow. When they decided slow, events including BP, California and Greece overtook them. G-20 just met in Toronto to face the facts. Financial reform subsequently announced last Friday supposedly made bank stocks rally, but they didn’t get very far. Is it over already? We wonder if the economy and market will make it to November elections to remove incumbents who got us into this fine mess.

“While we are not proponents of ripping the band-aid off with a pound of flesh, we think the damage way beyond a superficial cut or scratch that can be covered with more paper debt IOUs. The body politic is systemically riddled with cancerous debt-dollar usury.

Breaking legs, cement shoes or more economic hits by government mafia will not work.

It is clear after decades of failure the correct way to cure the malaise is not government amputation, monetary chemo or fiscal radiation, but letting free, natural markets do their healthy work to clear bad assets with creative destruction.

“Many may breathe a sigh of relief when Ben Shalom Bernanke and Barack Hussein Obama give up their quest to borrow, spend and tax their way to prosperity. We encourage everyone to read this link and call or write their representative to replace the failing 1913 Fed and IRS with this productive 28 basis point tax. Before our governments create Amnesty for Illegals, Drugs for Warlords and Revalued Chinese Yuan, let them first get our house in order.

“He who does not put out his money at usury, Nor does he take a bribe against the innocent; He who does these things shall never be moved. (Psalm 15:5)

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Gold backed or not, we most definitely have to take back the creation of money from private hands. howg

Well, I believe in a balance of power; let government create money that is legal tender for government debt only (taxes, fees, etc.) and let the private sector create private monies unbacked by any government privilege.