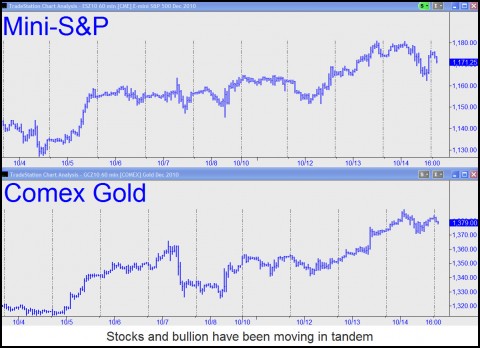

Stocks and bullion are moving so closely in-step these days that gold bugs may soon find themselves in the uncomfortable position of rooting for higher share prices. For many of them this will be quite a stretch, since gold and silver are popular now mainly because they’re regarded as hedges against the kind of economic disaster that would sink the stock market. To be sure, there are some who see the concurrent strength of shares and bullion as stemming from the same source – namely, inflationary pressures. The argument is solid and there is no way to refute it, since no one can say exactly why shares are rising. Whatever the reason, bullion’s ascent is easier to understand: It is occurring simply because the central banks have been inflating their respective currencies to the point of valuelessness. But while this ever-accelerating process of debasement has the

potential to drive precious-metal prices into the ozone, it seems unlikely that share prices would benefit from such a scenario, implying as it does a looming catastrophe for the global economy.

What this suggests is that although bullion quotes could conceivably be goosed to the moon if the world’s currency system were to collapse, shares prices could be driven only so high by panic. For in the final analysis, corporate stocks are tethered to the real world of earnings multiples, cash flow, inventory and depreciation in a way that gold and silver are not. And while the imagination can run wild with gold and silver valuations in a world presumed to have lost all trust in paper money, the future value of, say, IBM’s service contracts is going to be limited ultimately by more mundane concerns.

Extreme Predictions

So, if the stock market were to plummet, do we expect gold and silver prices fall with it? The answer is no, but only because we think stocks will ultimately be undone by a collapsing dollar. That’s not exactly a black-swan event, since nothing could be more predictable than the collapse of a currency that is already fundamentally worthless. But we strongly doubt that shares and gold would decouple sufficiently to simultaneously produce the extreme valuations predicted, respectively, by stock-market bears and gold bulls. To be more specific, although we think it’s at least possible that the Dow could eventually fall below 1000 as Bob Prechter has famously predicted, it seems inconceivable that an ounce of gold would be trading at that time for $5000 or more, as some well-known gurus have forecast. More likely, in our view, is that, come hell or high water, bullion will perform very well relatively to virtually every other class of investible asset.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

In another viewpoint from the same writer about negative implied rates, you have the reason why gold may be supported while equities and commodities may decline. It makes a fascinating and complicated read, if you follow the links ad infinitum:

http://ftalphaville.ft.com/blog/2010/08/04/306206/the-perils-of-releasing-the-repo-rate/

The upshot is that there is already massive short positions in treasuries and motivated buyers to settle those positions, even though they must engage in negative repos. Means that a treasury collapse is unlikely.