Using the Hidden Pivot Method, we were able to avoid wasting a day watching the markets do absolutely nothing on Tuesday. Instead, we lunched with our friend Josh at the Ten-Ten, a favorite Boulder bistro, then enjoyed the rest of the afternoon on the Pearl Street mall, soaking up some of the mid-60s temperatures that have settled over Colorado this week like a canopy of rainbows and rose petals. Those who have never visited Colorado’s Front Range probably think of postcards with snow-capped Rockies and assume the winters here are blustery. In fact, although there are occasional stretches of sub-freezing weather, shirt-sleeve days in mid-February are not all that uncommon. Imagine being able to enjoy them knowing that you’re not missing even a mote of genuine activity on Wall Street.

And so you could. You see, a little-known capability of our proprietary forecasting system is that it doesn’t get all antsy when nothing is happening. Indeed, the Hidden Pivot Method is as happy as a clam when it is forecasting those unendurable stretches of tedium that occupy the markets perhaps 90 percent of the time. Technically speaking, these hum-drum hours, days and even weeks are signaled on the charts by “dueling impulse legs.” Dueling impulse legs are simply upthrusts and downthrusts that happen in succession, each negating the last. String a few of them together on charts of different time frames and you get a picture not only of tedium in real time, but of tedium to come.

A Spectator Sport

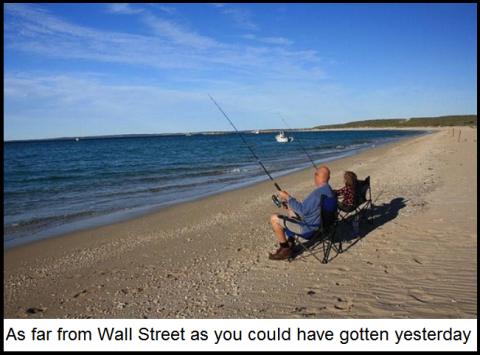

Yesterday morning, there were dueling impulse legs everywhere one looked: in the E-Mini S&Ps, in Gold and Silver — even in some world-beating stocks like Apple and Google. We’d come to our desk bright and early looking for possible excitement, since some bellwether stocks and index futures that we track obsessively look like they could be very close to important tops. We’d even thought to make a spectator sport of it, opening a virtual trading room online for Rick’s Picks subscribers who were looking for a stress-free way to get short. Alas, stocks did not leap from the gate yesterday, nor did they even approach our Hidden Pivot rally targets. Instead, the broad averages fell moderately in the first hour, then resisted what feeble selling made itself felt for the next five hours. We’d anticipated this during the online trading session, advising the approximately 80 subscribers who attended to hang out their “Gone Fishing” signs. Looking ahead, we still think a potential watershed top awaits, based on our bullish expectations for the shares of Apple. This Fat Lady-among-stocks has yet to sing, suggesting that the market as a whole is likely to go higher before it collapses, as we all know it must. If you’d like to tune in to Rick’s Picks’ price targets and our 24/7 chat room, click here for a free trial subscription. To learn more about the Hidden Pivot Method, or to register for the upcoming Webinar on March 2-3, click here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

“Gone fishin” …is absolutely perfect. It brings me a memory of my oldman’s philosophy.

We had a cottage by a clear water lake up in Manitoba …(look it up). The sign at the gate to the property said “Nothing Serious”. I retrieved the sign when the property was sold and it now hangs in my shop.

I can think of no better way to calm down about the reality of what is coming and all the machinations…(again, look it up) of people thinking that it will be possible to avoid that reality, except to reread that sign and a particular verse of the bible. Read Proverbs 3:5